Profit And Loss Statement Template: How To Create & Use (P&L) For Your Own Business

To assist determine profit, a profit and loss statement (P&L) shows your company's income against expenditures. Profit and loss statements are also known as income statements, statements of operations, and statements of earnings.

P&L statements may be used to evaluate and compare company performance over the course of a month, quarter, or year, and they're a useful tool for reviewing cash flow and forecasting future results.

Profit and loss statements, along with other key financial documents such as the balance sheet and cash flow statement, are used by smart business owners to monitor and improve the health of their companies.

How To Use Profit And Loss Statements

A P&L statement may help identify how a company has performed in the past and forecast how it will perform in the future, whether it sells products or provides services.

A profit and loss statement will offer you a decent sense of how things are going for new companies. The first stage, regardless of the kind of company, is to select the time period to be assessed-typically a quarter, but it may also be a month, a year, or even a week.

P&L statements are usually produced by owners or accountants and utilized by owners, officers, and shareholders to gain a sense of how the company is doing. A profit and loss statement may also provide a rapid snapshot of the condition of the company to prospective investors or purchasers.

Individuals may also use a profit and loss templateto keep track of their own expenditures and income in order to determine if they are saving money or spending more than they earn.

Accounting software programs may generate profit and loss statements automatically, but if your company doesn't use one, you can use one of the free profit and loss templates listed below.

These templates are in Microsoft Excel format, and you may download and modify them to meet your specific company needs. You may also utilize the templates to monitor revenue from numerous sources and to see your profit and loss statements for different time periods (monthly, quarterly, annually, etc.).

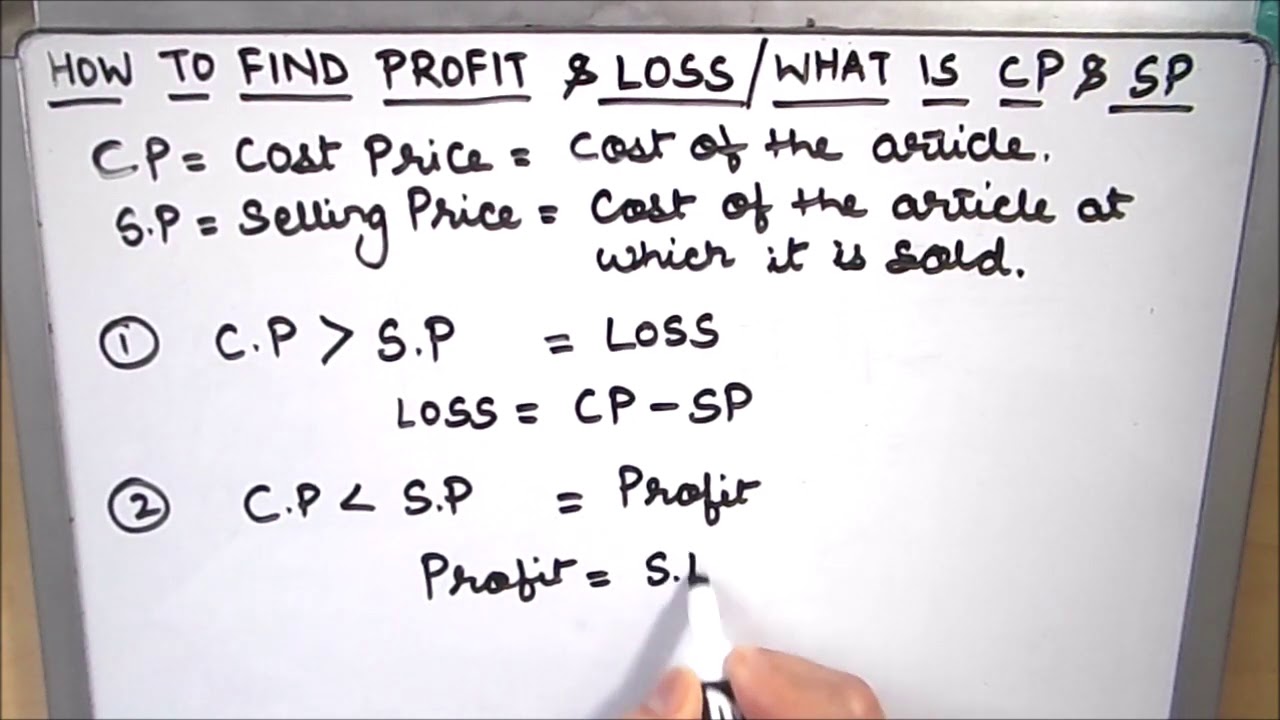

Profit And Loss Statement Formula

The net income of a firm is calculated by comparing revenue to expenditures on a P & L statement. To calculate your net profit or loss, subtract operating costs from revenue. You're earning money if your revenue exceeds your entire company expenditures.

The firm has incurred a loss if its expenditures were greater than its revenue during the time period under consideration. This metric is helpful for business owners and investors since it demonstrates a company's net profitability and efficiency in producing net income.

Create a monthly, quarterly, or yearly profit and loss statement, which you can examine and compare to performance over the same period in prior years.

How to find Profit and Loss / Calculate Profit and Loss using formula / Profit and Loss

Using Profit And Loss Template

The distinction between a company budget and a profit and loss forecast is minor, but it is significant. After generating a profit and loss forecast, you may simply rename your spreadsheet to "Budget" to indicate that you are finished.

However, if you are anything like me, your budget will be much more cautious than your forecast. When making a forecast, it is important to be as realistic as feasible.

The profit and loss template contains the same set of categories as the company budget, and further information regarding revenue categories and expenditure categories may be found on the Income Statement and Business Budget pages, as well as the Income Statement and Business Budget pages.

Profit And Loss Templates To Help You Monitor Your Business Income

Using a profit and loss template to track your company's revenue and expenditures can make your life simpler.

Everything you need is there at your fingertips, including an income statement, breakeven analysis, profit and loss statement template, and balance sheet with financial ratios. For peace of mind and transparency, choose one of our profit and loss templates to get the information you need when you need it.

Simply enter sales and expenses into your profit and loss statement template to determine your company's profit by month or year, as well as the percentage change from a previous period.

Profit and loss templates in Excel are simple to use and adapt to any company in minutes—no accounting background required.

To generate professional-looking papers to communicate with managers, partners, investors, and financial institutions, you may access and edit any P&L template to include your business name and logo. Start monitoring your company's finances now with a free profit and loss template.

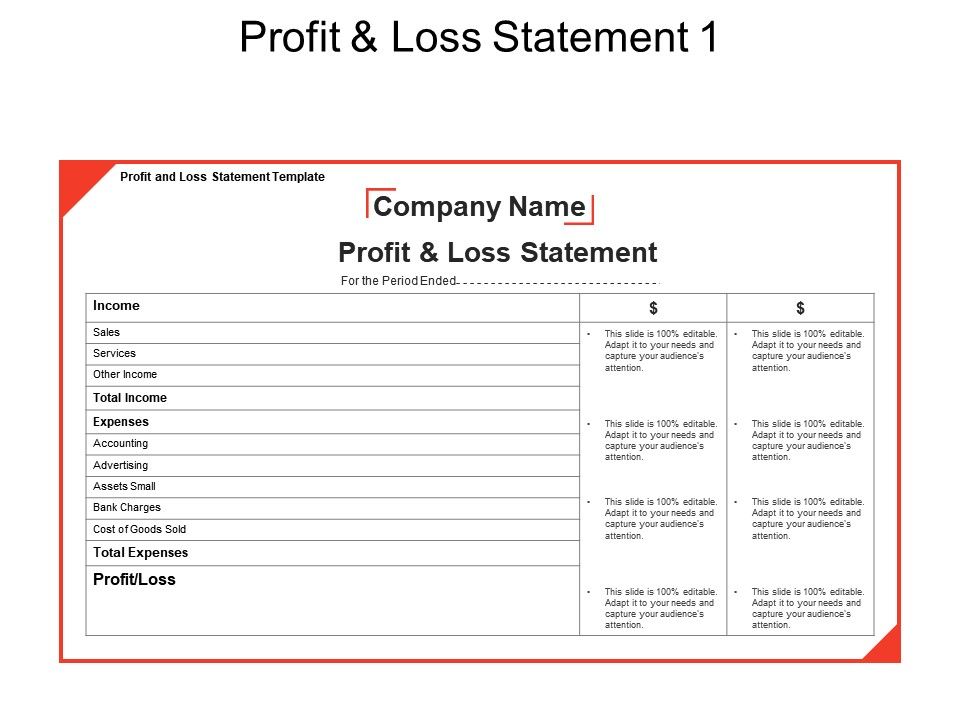

Profit And Loss (P&L) Statement Template

This profit and loss (P&L) statement template describe a company's income and expenditures over a period of time to calculate net profits.

How To Make Profit And Loss Statement In 6 EASY STEPS

Monthly Profit And Loss Template

The monthly P&L template is ideal for companies that need detailed reporting on a regular basis. When all of the data is shown in a series of monthly columns, considerably more detail can be seen than if just the yearly numbers are displayed.

Revenue, cost of goods sold, interest expenditure, profits before taxes, and net income are all line items. The monthly profit and loss template is ideal for small, medium, and big companies since it can be readily customized to include or exclude details as needed.

Annual Profit And Loss Template (P&L Template)

An annual (full year or year to date) statement may be useful for companies that have been in existence for many years. The yearly profit and loss template below has the same style and structure as the monthly version, but it lacks a total column at the end that adds up each period.

This template is suitable for any size company and can be readily customized by adding or deleting line items (rows) as required.

Profit And Loss Statement Spreadsheet

A profit and loss statement is a crucial tool for determining not only how well your company has performed in the past, but also how well it will do in the future.

It may be useful in assisting you in developing a yearly revenue forecast as well as demonstrating to investors and creditors why they should invest in your company.

This spreadsheet can track revenue from up to four distinct goods or services, making it versatile. Please review the unique restaurant profit and loss statement we developed for restaurants that have somewhat different sales and expenditures than other companies.

It's set up to operate over the course of a year, with four columns for data entry in each of the four quarters. If you need a forecast for a longer length of time, just change the wording to display statistics for whole years rather than quarters.

If you need a balance sheet rather than a profit or loss statement, please check our balance sheet spreadsheet.

Creating A Profit And Loss Statement In A Minute

You may quickly generate a crude profit and loss statement if the revenue and expenditure data are easily accessible.

Sales receipts will be used to calculate revenue, and the cost of products sold will comprise raw materials, overhead, and any labor expenses involved with producing the items or services you're selling.

All money spent in order to operate the firm, such as rent, taxes, and salaries, will be included in expenses. To obtain a fast picture of where the company stands for the chosen time period, fill out the relevant areas in the basic form below.

How To Create The Profit And Loss Statement Template

Select a time frame from the drop-down menu. To create the revenue statement, choose a time period from which to generate data; this might be one month, three months, or a year, for example.

- Add up all of your earnings and expenditures. Fill in the blanks with your company's revenue and expense figures. Line items may be added or removed as needed.

- Make sure the profit and loss statement is tailored to your company's needs by adding and deleting line items as needed.

- When necessary, you may simply add a line to the template, or you can remove lines from the template as needed.

- Check the formulae one more time. Check to verify that the formulae are functioning as expected.

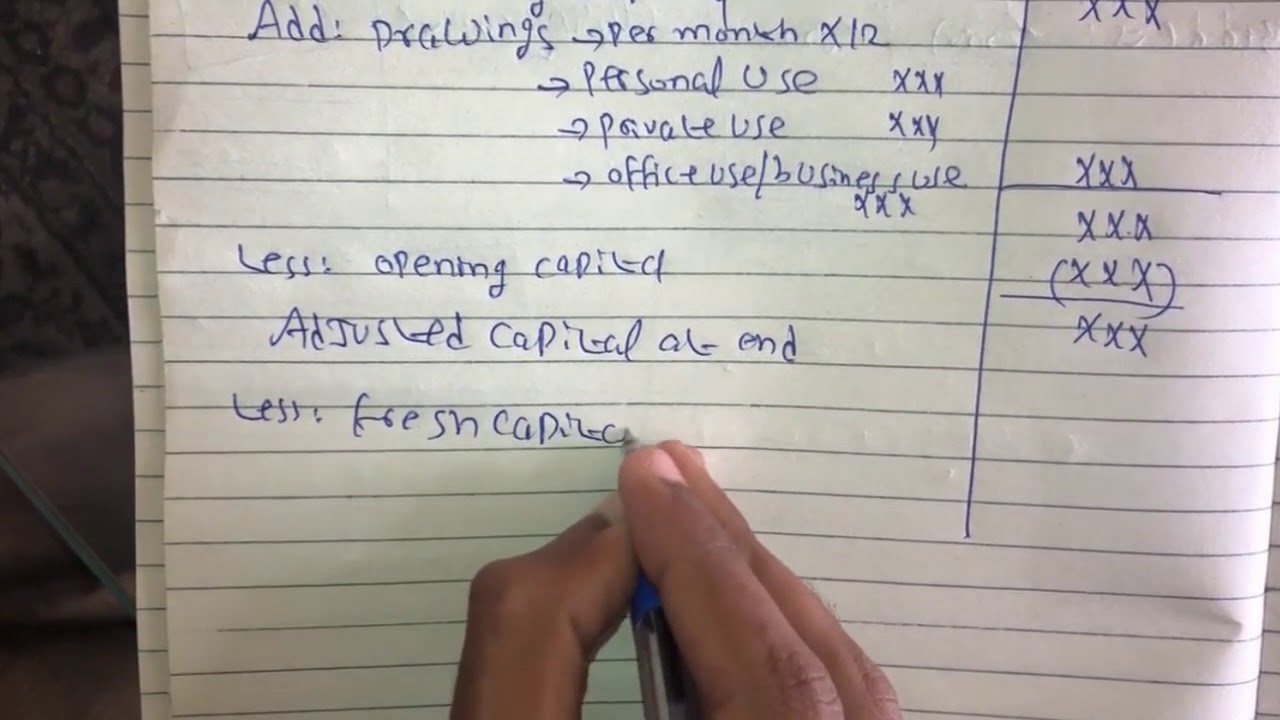

How to Prepare Statement of Profit & Loss under Single Entry System Format - Hindi/Urdu

Profit & Loss Statement Template Includes

Consolidated Statement of Profit or Loss | Explained with Example

Detailed Description

On the spreadsheet, there is room to add everything you'll need to generate a profit and loss statement. Only the white cells, which should include data from each quarter, need to be filled up. Based on this data, the spreadsheet will compute percentages and totals automatically.

Income

The revenue column of your spreadsheet enables you to keep track of any money you earn from product and service sales. By simply clicking on the cell and typing over it, you may insert the names of your particular goods and services in column B (instead of the Product/Service 1) text.

Once you input your sales income and cost of sales data, your gross profit will be computed automatically. Fill in the blanks here if you get any non-operational revenue, such as rent or interest, since this will be used to determine your overall income.

Your total income will be determined by subtracting your cost of sales from both your sales revenue and non-operation income.

Expenses

Operating costs and non-recurring expenses are divided into two sections the expenses section. All of this information will be combined in the spreadsheet, which will give you a total of your expenditures.

The operational costs part is divided into three subsections to make filling it out simpler. In the Other costs part of each of these subsections, you may add up to two extra expenses (specify).

This information, like the goods and services, may be put in. Standard advertising and direct marketing are covered in the marketing and advertising section. You may keep track of expenditures such as technology licenses and patents in the development section.

The administrative area is the largest of the three subsections, enabling you to keep track of everything from salaries to office supplies and building upkeep.

It's important to keep track of non-recurring expenses separately because it's easy to see how much you spent on things like computer software and hardware that are unlikely to need replacing for several years when analyzing the data in your profit and loss statement if you've made a loss or the profit margin is low.

Taxes

The amount of tax paid varies by nation and, in many instances, even by area within a country.

As a result, this spreadsheet does not attempt to compute the amount of tax you have paid; instead, it provides room for you to enter in all of your tax information, including income taxes, payroll taxes, and real estate taxes. You may also select and input the details of any additional taxes that apply to you.

Net Income

In the spreadsheet's net income area, there is nothing to fill out. It simply subtracts all of your expenditures, including taxes, from your total income.

Share Distributions/Dividends

As an owner or shareholder, you may get dividends instead of or in addition to your salary, depending on how your company is set up. This data must be entered in order for the spreadsheet to compute your net profit properly.

Net Profit

There is nothing to fill out here, just as there isn't anything to fill out in the net income area. The spreadsheet calculates your net profit by subtracting your net income from any share distributions and dividends, both in terms of real figures and as a percentage of your sales.

If you fill in data for more than one quarter, the total for the year will be put together (Year to Date). This data comes in handy when putting together a financial forecast.

Increase Transparency With Smartsheet For Profit And Loss Statements

With a flexible platform built to meet your team's requirements and adapt as those needs evolve you empower your employees to go above and beyond. Smartsheet makes it simple to plan, record, manage, and report on work from anywhere, allowing your team to be more efficient and productive.

With roll-up reports, dashboards, and automated processes designed to keep your team connected and informed, you can report on important metrics and receive real-time insight into work as it occurs.

There's no knowing how much more a team can achieve in the same amount of time when they have clarity about the job they're doing.