Tips For Creation Of Perfect Profit And Loss Template 2021

Even if you don't need money from a bank or other lender to start your small company, you'll need various financial documents to make certain judgments. A profit and loss statement is the most crucial financial statement for any firm (called a "P&L"). It's also known as an income statement. This statement depicts the business's income and costs, as well as the profit or loss, over a specified time period (a month, a quarter, or a year). Here are important keypoint

- The profit and loss statement is a financial statement that details income, expenditures, and spending for a certain time period.

- The P&L statement, together with the balance sheet and cash flow statement, is one of three financial statements that every public business releases quarterly and yearly.

- The P&L statement, balance sheet, and cash flow statement, when utilized together, give an in-depth look at a company's financial performance. The cash or accrual method of accounting is used to create financial statements.

- P & L statements from several accounting periods should be compared since any changes over time become more relevant than the figures themselves.

When Do I Need To Prepare A Profit And Loss Statement?

Periodic P&L: Every firm should create and analyze its profit and loss statement on a quarterly basis at the very least. Examining the profit and loss statement assists the company in making choices and preparing its tax return. The information from the P&L will be used to calculate net income on your business tax return, which will decide how much income tax your company must pay.

Pro Forma P&L: At the commencement of a new firm, a profit and loss statement is required. This statement is pro forma, which means it is forecasted for the future. When requesting financing for a new business endeavor, your company will also require a pro forma P&L.

Use Statements Of Profit And Loss Template

A P&L statement may help assess how a firm has performed in the past and anticipate how it will perform in the future, whether it sells things or provides services. A profit and loss statement will offer you a decent indication of how things are going for new enterprises.

The first stage, regardless of the sort of company, is to identify the time period to be reviewed-normally a quarter, but it may also be a month, a year, or even a week.

P&L statements are usually created by owners or accountants and utilized by owners, officers, and shareholders to obtain a sense of how the firm is doing. A profit and loss statement may also provide a fast snapshot of the health of the firm to prospective investors or purchasers.

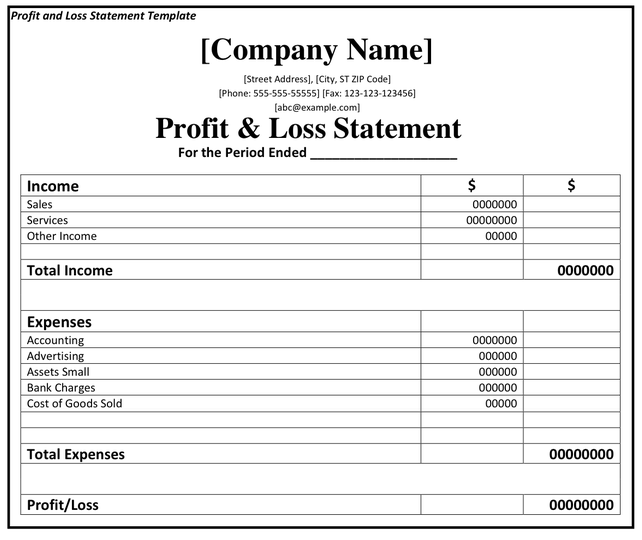

Individuals may also use a profit and loss templateto keep track of their own costs and income in order to determine if they are saving money or spending more than they earn.

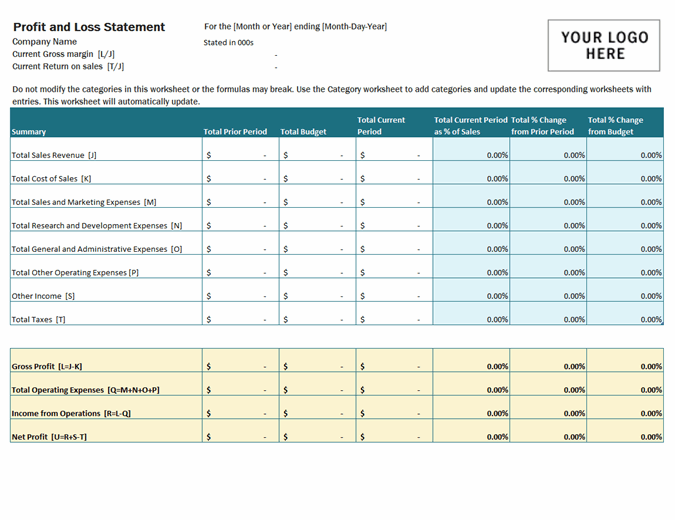

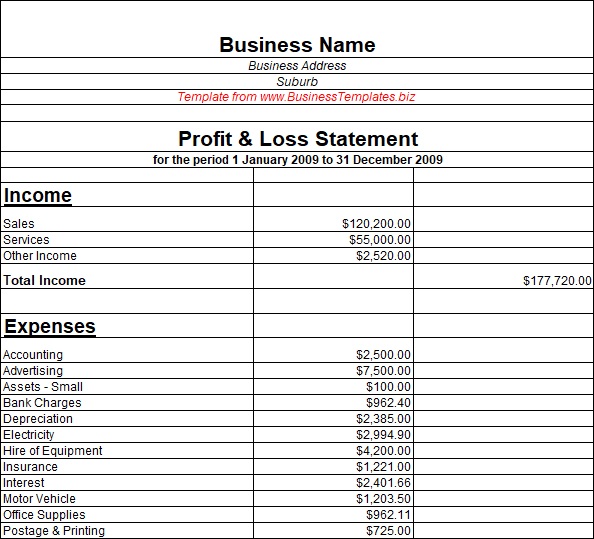

Accounting software programs may generate profit and loss statements automatically, but if your company doesn't use one, you can use one of the free profit and loss templates listed below.

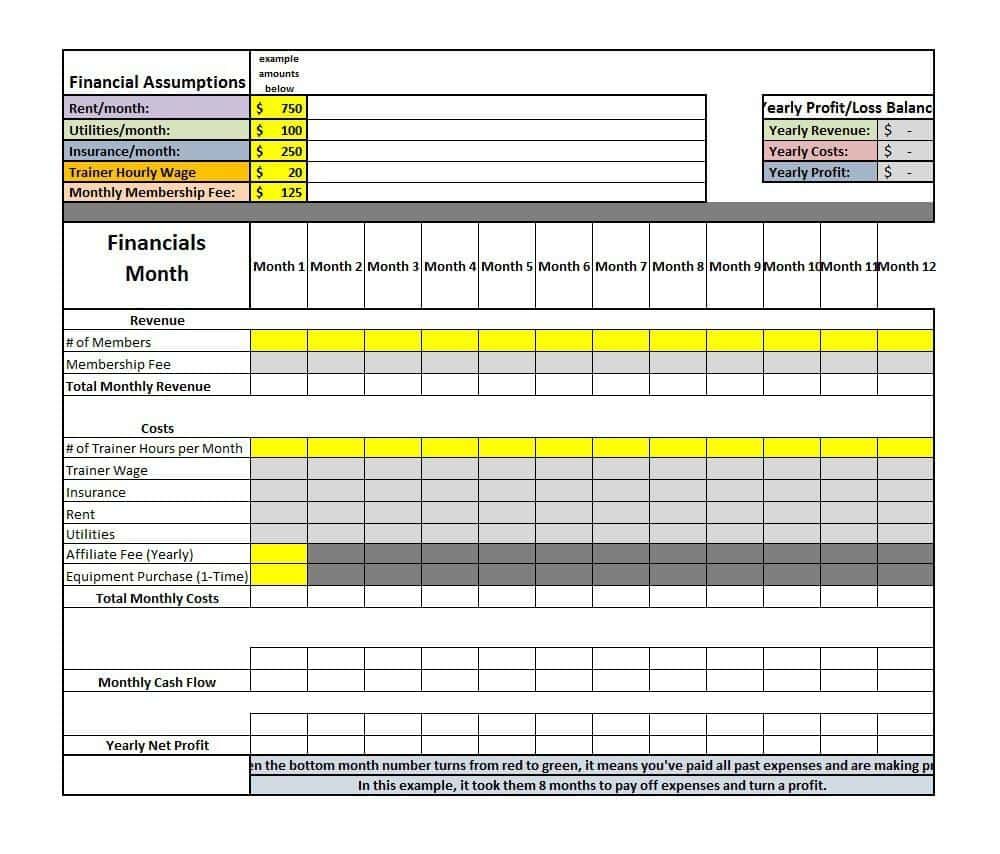

These templates are in Microsoft Excel format, and you may download and alter them to meet your specific company needs. You may also utilize the templates to monitor money from many sources and to see your profit and loss statements for different time periods (monthly, quarterly, annually, etc.).

What Information Do I Need To Prepare The Profit And Loss Template?

The majority of the data for this statement comes from your first-year monthly budget (cash flow statement) and your tax advisor's expected depreciation estimates. You'll need the following items in particular:

- All of the transactions in your company checking account, as well as all of the purchases made with your business credit cards, are included in this document.

- Include any monetary transactions for which you have receipts, such as petty cash.

- You'll need a list of all sources of revenue, including cheques, credit card payments, and so on. On your bank statement, you should be able to locate them.

- You'll also need details on any price reductions, like as discounts or refunds.

The profit and loss statement should be included with the normal reports if you're using business accounting software. Even if you already have this report in your system, you should be aware of the information needed to produce it.

Preparing A Pro Forma (Projected Profit And Loss Statement)

When establishing a firm, you don't have enough information to construct a proper P&L statement, therefore you have to make educated guesses. A pro forma statement is typically generated for each month of the first year in operation, but your lender may ask you to include additional months or years in the forecast to illustrate the break-even point or the point at which your firm generates regular positive cash flow.

- Make a list of all conceivable costs, overestimating so you don't get caught off guard. Don't forget to include a "miscellaneous" category and a sum.

- Make a monthly sales forecast. Underestimate sales in terms of both time and volume.

- For a period of time, the gap between costs and revenues is generally negative. The negative figures should be added up to obtain an indication of how much money you'll need to get your firm off the ground.

How to Create a Business Plan - Part 6 - The Projected Profit & Loss Statement #businessplan

Preparing A Periodic Profit And Loss Template

Whether you're creating a statement for a startup, tax preparation, or company analysis, the method and information required are the same. There will be a quarterly amount for each row, followed by a year-end total.

- To begin, display your company's net income (commonly referred to as "Sales") for each quarter of the year. If you choose, you may divide down the revenue into sub-sections to demonstrate money from various sources.

- Then, for each quarter, categorize your company costs. Each expenditure should be represented as a proportion of total sales. The sum of all costs should equal 100 percent of sales.

- Then, Earnings, indicate the difference between Sales and Expenses. This is also known as EBITDA (earnings before interest, taxes, depreciation, amortization). 8 Then deduct EBITDA from the total interest on your company loan for the year.

- After that, make a list of taxes on net income (which is generally approximated) and deduct them.

- Finally, remove the entire depreciation and amortization for the year.