Creating A Loan Agreement Template In 2022

When it comes to legal forms and templates, the loan agreement templateis very important. Whether you are the person borrowing the money or the lender, this contract is necessary.

Most people don't want to borrow from a bank, but there are few sources of funding that are legally recognized and can be capitalized for activities and purposes that do not take the risk of borrowing encountered by loan sharks. When a person applies for a loan, it is only the beginning of a long and often withdrawn process before the loan is finally approved by a higher official. Banks need to be secured which means rigorous background checks, including health, financial status, employment security, and criminal records may be imposed on candidates.

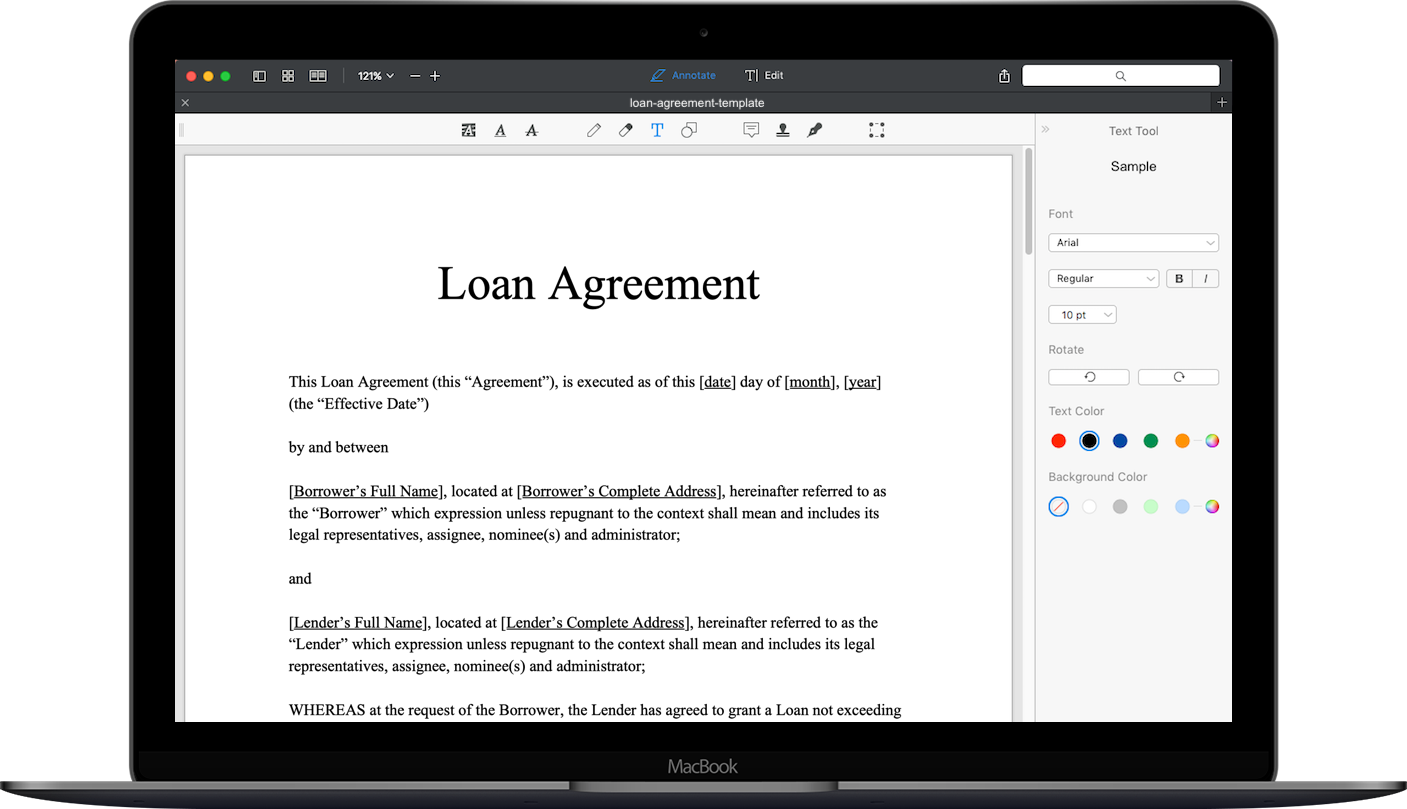

However, once all the formalities are done and the loan request has been approved. Formal documentation is usually concluded which is usually called Loan Agreement. A Loan Agreement template is formal business documentation that is used to convey the approval regarding the person’s application. It must have a polite tone, providing the parties with all the necessary information about the formalities that may need to be completed as well as conditions about the payment of the loan. Read through this article to learn more about Loan Agreement templates.

What Is A Loan Agreement?

What is a Loan Agreement EXPLAINED

A loan agreement is a written agreement between two parties, a lender and a borrower, which can be enforced in court if one party does not follow the negotiation. A lender is a person who provides a loan to a borrower. The borrower is the person who will receive the loan. The borrower agrees that the borrowed money will be repaid to the lender at a later date, possibly with interest. In return, the lender cannot change his mind and choose not to lend money to the borrower, especially if the borrower relies on the lender's promise and makes a purchase in the hope that he will receive the money immediately.

Loans are now a common thing and part of day-to-day finance in our society. Some loans are large and usually provided by banks for home buying or business, while others are for purchasing purposes. There are also small or personal loans that often occur between small businesses and individuals, or among family and friends. It is often said that loaning money is the fastest way to ruin a relationship or bond; however, when you follow a loan agreement, you can minimize or avoid many problems or issues. When you loan any amount of money, be it two hundred dollars or a thousand, it’s important to have and sign a loan agreement template. A simple loan agreement in writing should have the following basic elements:

- Borrower: (aka. the “buyer” or “payer”) the person who is receiving the money and will pay it back.

- Lender: (aka. the “issuer”, “maker”, “payee”, or “seller”) the person who is giving the money and will get the money back.

- Principal Amount: the sum or amount of money being borrowed

- Interest: additional money owed, usually a percentage of the amount borrowed

- Maturity Date: the date when the money should be repaid

Why Is It Important To Have A Loan Agreement?

Why should you use a loan agreement template when loaning? Simple, because of what might happen when you don’t. When loan agreement templates aren’t followed, some issues may arise wherein the lending party can lose some or all of the money owed with no certain legal resolution. Without following a sample loan agreement, you can't enforce it when the loan is not paid. There are also some of the lending companies that are scamming and putting high percentages on the loaned money. That is why a loan agreement also serves as a protection for the borrower’s side too. To check out some Most Trusted Mortgage Loan Platforms you may visit this website.

In legal cases involving loans without loan agreements, the court has undergone a keen investigation to find out who is telling the truth about the terms and conditions of a loan. Even if you are lending to family or a close friend, it is still important to complete a loan agreement template. This loan agreement template works not only to protect your loan, but also the integrity of your relationship.

How Do You Write A Loan Agreement?

Loan agreement templatestend to prevent lenders from being cheated while clearly explaining loan terms to protect all involved parties. A well-crafted loan agreement should clearly state all components of a loan. You should ensure the language you use prevents any possible misunderstandings. Loan agreements should make clear that a loan is not a gift and it should be repaid. Thus, the agreement should have detailed payment requirements, frequency of installments, full repayment date, late charges, etc.

- The language should be simple and direct.

- Avoid ambiguous words and terminology.

- State everything in clear and concrete terms.

- Make sure both parties understand all their terms and conditions.

- Once done in writing the agreement, please recheck it for any errors.

Conclusion

Loan agreements are critical arrangements that require substantial financial literacy. Whether you are considering loaning money to a friend or family member, ensuring you fully comprehend a home loan, or are looking to modify a bank loan, a loan agreement is a big help. Filling out a simple loan agreement ensures that there is no misunderstanding between the lender and the person in need of funds. The terms of a loan agreement might seem to be difficult and tedious to draft. However, a loan agreement template makes the task of document creation easier. We hope this guide provides you with a greater understanding of how to create loan agreements.