Importance Of Receipt Template: How To Make Own Receipt Template In Simple Steps

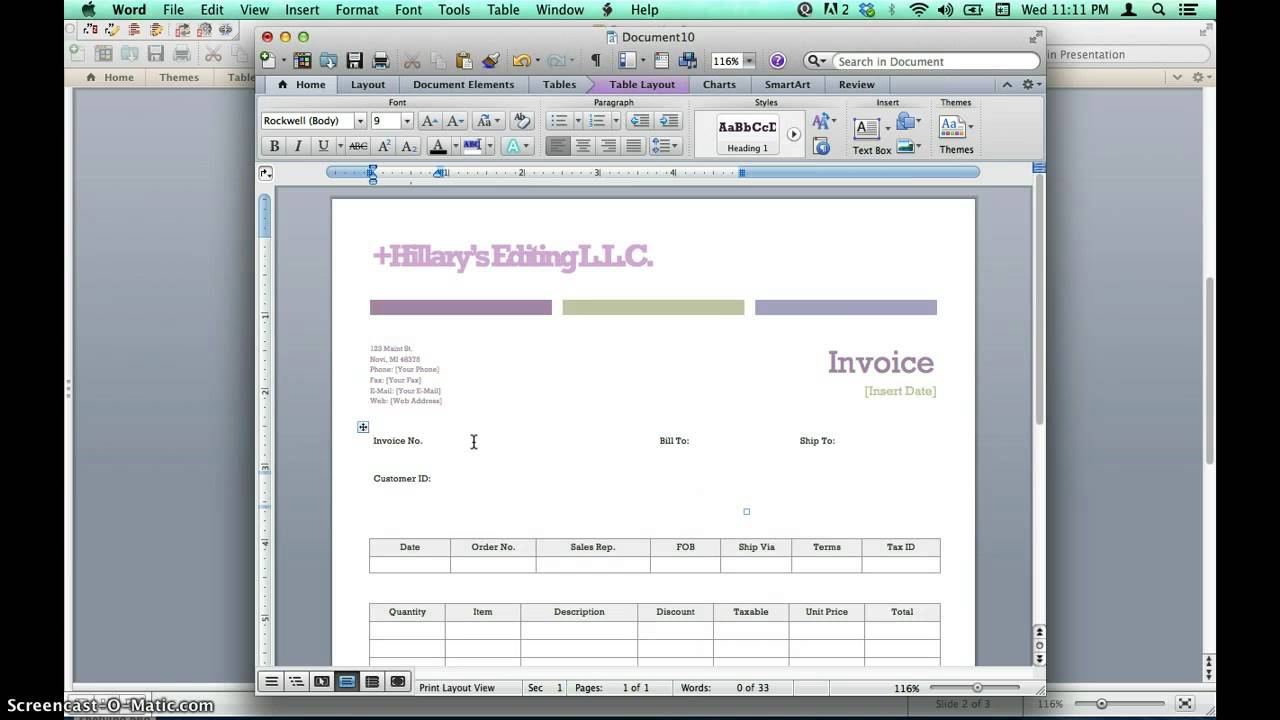

If you don't have or don't want to use Excel, the Word receipt templateis an excellent option.

Microsoft Word allows you to insert a table that can do basic arithmetic calculations, such as adding, which is what we've done on this template to sum the total worth of coins and cash, saving you time from having to do it yourself.

Instructions To Use Receipt Template

Because this word receipt is a template, you will be asked to save it to a new document when you make changes to it. As a result, your original template will remain precisely as it was when it was downloaded. There are text fields in this template.

To navigate between fields in the document, use the ‘tab' key on your keyboard. When you do this, the fields will be highlighted (as shown in the picture above), and you may begin entering the transaction information.

By highlighting and entering, you may immediately replace the template information with your own no need to remove or backspace it beforehand. If you need to click within a field with your mouse cursor, you may do so, but it will not highlight the whole area.

You may accomplish this by clicking on the dotted tab on the left, which is circled in red in the figure below. Simply go to the 0.00s and enter your numbers in the ‘amount paid' column; you may leave the total for now since we will perform the automated calculation.

You will see the ‘Choose an item' option, which allows you to choose between checks and cheques depending on where you are in the globe. To get the total, use Ctrl + A on your keyboard to highlight everything, then F9.

This includes coins, bills, and checks or cheques. You may print your receipt after you've double-checked it and are satisfied with it. To print the receipt, use Ctrl + P or your printer icon.

Sign it in the lower-left corner. Keep one in your file and deliver the other to the person who gave you the money. Of course, if you want to conserve paper, you may save or print this receipt as a PDF or Windows image and send it to the payer, as well as store it on your computer or online electronic storage.

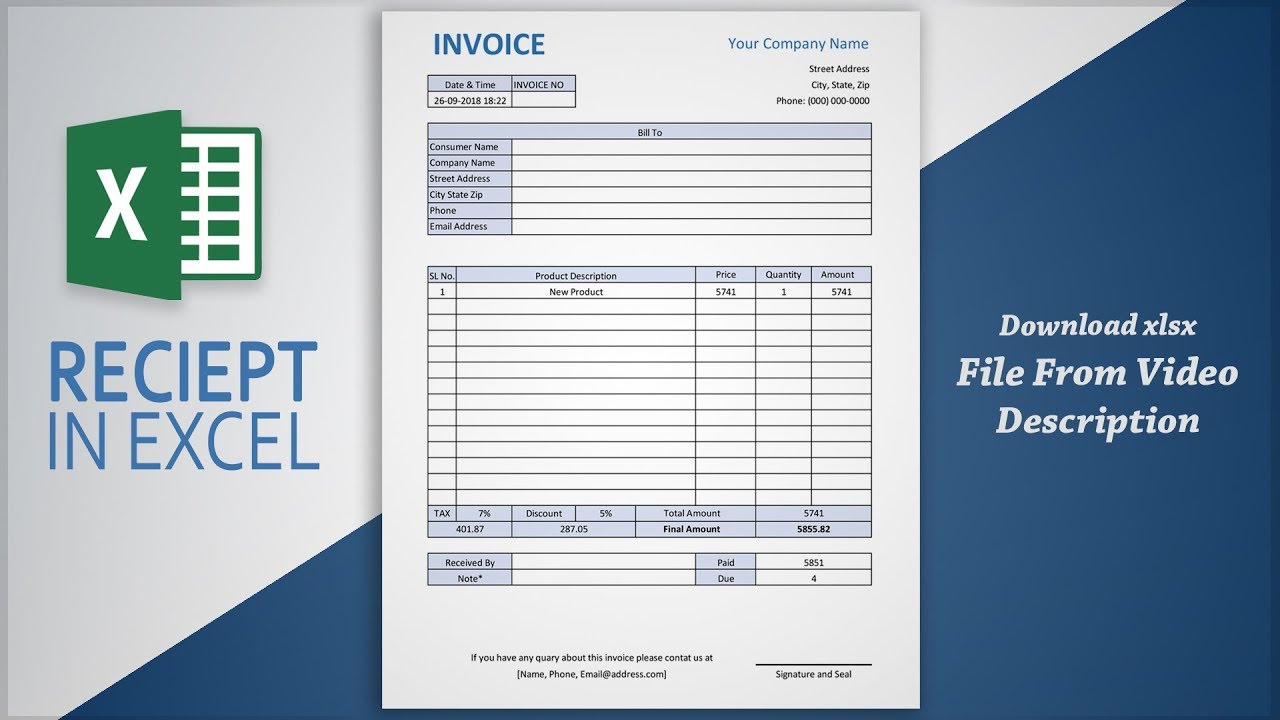

Creating Professional Invoice in Excel | Receipt Making Tutorial | Free Template

Importance Of Issuing A Receipt Of Payment

Payment receipts are critical for giving information to consumers, assisting with internal accounting, and documenting transactions. The following are some of the most important purposes of a payment receipt:

- When a buyer receives a product that is faulty or not of the intended quality, they may return it provided they have the original purchase receipt.

- This receipt contains important information regarding the return policy, such as the number of days that items may be returned to the vendor after purchase.

- Payment receipts provide information about the consumer and aid in seamless communication between the buyer and vendor.

- This is feasible because it contains all of the necessary information about the purchase of goods or services from the vendor, such as the number of items purchased, taxes, purchase date, and taxes.

- As a result, it helps to guarantee that there are no disagreements between the parties involved since all the information is set forth.

- Accounting on the inside: Sellers retain copies of payment receipts because they help them keep accurate records of sales and income.

- As a result, if a problem occurs in the future, you may always turn to the payment receipt for clarification.

What Is A Receipt|Importance Of A Receipt In Business.

Information On A Payment Receipt

The payment receipt contains information that shows the buyer's description of the goods bought. The following are examples of such data:

The Due Date For Payment

The payment date is used to indicate when products or services were sold to a customer. The date on a receipt may be used to keep track of how long specific goods have been on the market.

The information may be utilized to resolve issues with defective products returned within the warranty period; the date on the receipt indicating when the item was purchased determines whether the item is returned within the warranty period.

The Receipt Number

This is a number that is produced after all of the products and services sold have been paid for in full. The number may be a series of numbers that include the date of the transaction and the precise moment the receipt was issued.

Information About Your Credit Card

The credit card information on the receipt contains the date and time of the transaction, as well as a portion of the seller's account number, the reference number, and the amount charged in that transaction.

Total Amount Received

Receipts indicate the amount of money received through the sale of products and services by the company. The money received aids the company and its owners in keeping records that allow them to determine the amount of money they have made. The information may also be used by the company to reduce the risk of future losses.

The Method Of Payment

The method of payment used by various consumers to pay for products and services helps a company maintain track of and understand the primary ways utilized by its customers.

At the request of its customers, the company may add a form of payment, which might include online payment systems like PayPal. This guarantees that the company does not lose money as a result of the absence of a certain payment option.

The Remaining Payable Balance

In instances when the invoice is relevant, the remaining amount owed is often utilized, and the company may use this to monitor any outstanding payments.

The information may be used by the company to expedite payments for products and services provided to customers and other organizations that have yet to complete payments or who have made partial payments to the company.

Information About The Seller

This section contains information pertaining to the seller, such as the seller's physical address and contact details. This may be utilized by a consumer, an organization, or a company that utilizes or buys products or services from a certain supplier.

Without having to physically visit the company premises, the buyer may utilize the seller's contact information to inquire about products and the amount that is now available.

Details Of The Transaction

Transaction details provide detailed information on the goods purchased or sold, as well as the payment methods utilized, as well as the date the transaction occurred.

The following are the specifics of the transaction: The item bought that is highlighted in the transaction information of a receipt refers to the commodities that a consumer has purchased.

This information is critical to the company because it allows it to maintain track of the rate at which particular commodities are purchased and give evidence of the exact item purchased by a client in the event of a return.

When it comes to stock taking, the quantity bought information on a receipt is helpful.

The company may determine the amount that has to be raised as well as the precise margin. They may use this data to monitor their customers' purchasing patterns, and in the long run, they'll be able to identify the most popular products that are often bought and eliminate the less popular ones.

This part of a receipt is intended to emphasize the person to whom the receipt is addressed—in this instance, the consumer or organization that made the transaction. The company may utilize the information in this area to identify the products that consumers buy, as well as to develop better service delivery that is customized to that customer.

Received from: This section is used to identify the person or business who issued the receipt. It confirms that items were sent and that money for them was received by the company. As a result, the transaction is considered complete. In certain cases, this may be used to identify the individual employee in the company who completed the sale, and therefore the commissions for that person can be calculated.

Customers and other organizations who get receipts from various companies may benefit from a company's or business's logo being included in the receipts they issue, which is part of brand marketing.

In this case, the company logo may help the consumer immediately recognize which business organization issued the receipt without having to go through the items mentioned on the ticket.

Receipt the number from the beginning. The original invoice number is exclusive to a single invoice and is used by companies to keep track of sales and invoice amounts. The invoice number may also be used by the company to monitor payments and record payments that have not yet been received.

The number is important for accounting reasons, as it keeps track of taxes paid by the company and guarantees that the invoice is a legal document since it is not regarded legitimate without the original invoice number.

Creating An Receipt Using A Word Template

Because it is accessible and familiar to many individuals, Microsoft Word is a popular choice for busy freelancers and industry workers.

You can be certain that FreshBooks will make your payment process as easy as possible by providing a wide range of free word receipt templates to suit any situation.

To generate a receipt using a pre-existing template, open Microsoft Word and choose File, then New Template. Type "receipt" into the search box in the top right-hand corner to narrow down the template results.

Select a receipt template that best meets your business's needs and double-click it to open it. Save the document to your computer after you've done modifying it. After you've selected the right template for your company, you may be on your way to changing your receipt in minutes.

If you only need a simple blank receipt template, though, the Microsoft Word template is a great place to start. You may find detailed step-by-step instructions for generating a receipt from a Word template here:

Creating Invoices Using Microsoft Word Templates

Create A New Word Document To Begin

Open Microsoft Word, select File, and then pick New From Template from the menu to create a new receipt using a Word template. You should be able to choose from a range of printable receipt templates depending on your company, unique design style, and the kind of services given.

Decide Receipt Template

You may either browse through the template options in Microsoft Word or filter them to view the most relevant ones first. To do so, go to the top right corner of the screen and search for "receipt" in the search box.

Look for a template that meets the needs of your business. Templates for sales receipts, service receipts, and other kinds of receipts are available in Word. Choose a design that matches the image of your business.

With free blank receipt templates, you have a lot of options for making your business stand out. Your customer will appreciate your professionalism since billing is an important part of the service process.

Make A Copy Of The Receipt Template And Save It On Your Computer

Double-click a receipt template after you've found one that meets all of your needs. In a new Word document, the template design will emerge. You may create a variety of customizable printed receipts using Microsoft Word. You may send your receipt to your customers' inboxes through email, or you can mail it to them if they prefer the traditional method.

Create A Unique Receipt Template

After that, edit the receipt template to include all of the relevant details from the work you just completed. A free receipt template will be organized to show all of the most important business information, ensuring that your receipt is accurate.

It's important to fill out the forms correctly, since supplying inaccurate information may cause your payment to be delayed. Make sure you include the following information:

Include it here if you have one. Your company's contact information, including your name, address, phone number, and email address Your customer's contact information This is a one-of-a-kind receipt number that may be used as a reference.

Payment is due on this day. An itemized list of the services you provided to the client, including the number of hours you worked and the price you charged.

A subtotal for each of your services. Your payment terms, such as the payment methods you accept and any late penalties you impose. The payment deadline has passed.

The total amount payable for the receipt, including any applicable taxes. If you need additional details, check out this article, which goes through the intricacies of what to include on your receipts.

Keep your receipt in a secure location. Once you're happy with the receipt, save it to your computer. You may save it as an editable.docx document as well as a PDF document, ensuring that the final version you provide to clients is secure.

If you think you'll need to add more information later, it's OK to save your receipt as a word doc first. This gives you the freedom to add more services as needed, as well as change your hours and material pricing. However, before delivering it to your client, you should save it as a final PDF version.

When sending receipts to customers through email, keep this in mind.

Submit Your Receipt

Send your receipt to the client in whichever format is most convenient for you, whether it's via mail or email. Include a short cover letter that highlights the most important details, such as the amount owed and the payment deadline.