How To Create Payment Schedule Template In Simple Steps

A payment schedule templateis a tool for keeping track of the dates on which one party must pay another. Without a doubt, the payment plan is one of the most effective instruments for keeping track of payments.

To create a payment schedule, however, a number of processes must be followed, including determining the number of weeks in which payments must be made. This financial instrument timetable establishes the times and dates when one party makes a cash transaction with another. It is often a form of schedule in which dates or a timeline are established for different payments to be paid to a contractor.

Importance Of Payment Schedule Template

If you're paying many parties, your payment schedule should prioritize your payments based on their urgency. This schedule may be used for personal or commercial purposes. A payment plan, without a doubt, makes your payment procedure less stressful and allows you to make payments in little increments rather than all at once.

In general, it is a procedure that establishes when, how, and in what form payments for a certain transaction must be made. A schedule may be arranged in a variety of ways, based on the parameters agreed upon by the two parties, but most schedules will have a few fundamental aspects.

Details Of Payment Schedule Template

The following points should be included in a well-written payment plan: The frequency of payments should be shown on your payment schedule. It should be written to suit your needs, whether you choose to make your pavements weekly, monthly, or yearly.

The payment schedule should indicate the day on which the payment will be paid when an equal amount of time has passed. The optimum payment schedule is one that adjusts payments on business days.

However, if the payment date falls on a non-business day, you must use the date rolling element. The payment schedule should include the dates of the first and final payments. This style is simple to use, and the user may design a payment plan without the assistance of a professional.

Types Of Payment Schedule Templates

Payment schedule templates come in as many varieties as there are payments to be made. Despite their differences, they all serve the same purpose: to assist the payer in preparing an ordered payment list in accordance with his payment criteria. Many forms of payment plans are shown below.

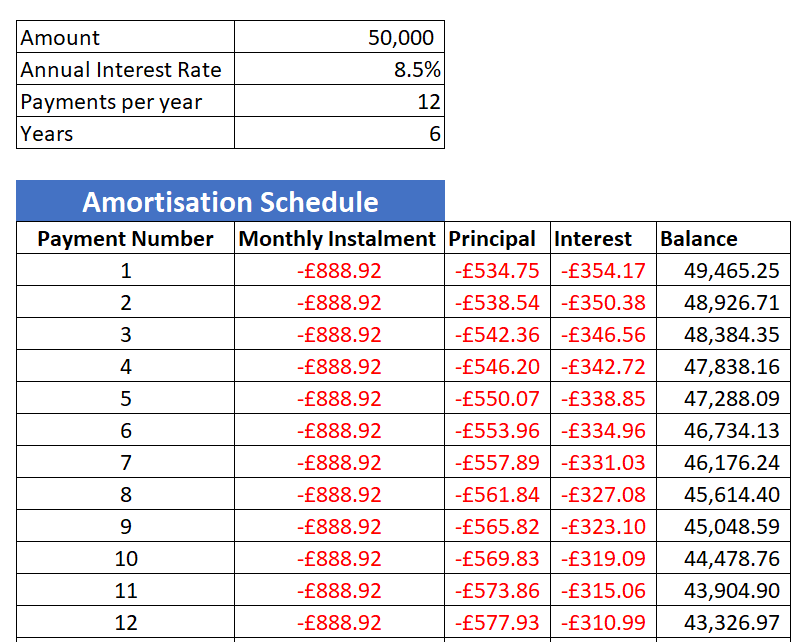

Loan Payment Schedule Template

This template is used to keep track of the due date for each loan, the amount due, the interest, and the firm or person that gave the loan. Credit businesses, mortgage firms, and shark tanks are the most common users.

Bill Payment Schedule Template

This template is intended to keep track of the many invoices a firm receives each month, as well as the amount owed on each bill. It records invoices for services such as water, electricity, telephone, sewage, waste collection, and so on. The template includes the service provider's name, payment due date, and amount.

Project Payment Schedule Template

It's used to keep track of project payments in accordance with contract requirements.

Construction Payment Schedule Template

Contractors use it to make payments based on the progress of a project per phase and the overall worth of the project.

How Is The Payment Schedule Calculated?

Begin by writing down all of the payment information that the firm has agreed to. If it's employees, make a list of everyone's names and the date they started working for the company.

Next, according to the agreement of employment, write down how much each employee has agreed to be paid. Fill in each employee's payment date as well as additional information such as overtime accruals, social security deductions, loan deductions, and advances, among other things.

The employee will be paid in full on time. If the firm has bills to pay, the bill payment schedule template may be used to keep track of them. Divide the schedules by the days on which payments are made, which might be daily, weekly, fortnightly, or monthly, and match them to the names of the workers who get payments on those dates. After you've finished your draught, open your payment plan template and start filling in the blanks using the procedures below.

Name Your Monthly Payment Schedule

Use the name payment recurrences, which might contain the names of teams such as lab technicians, managers, support personnel, errand runners, and so on.

Insert The Date

Include the date of the first payment and the date of the most recent payment. Daily, weekly, fortnightly, and monthly payments all follow the same procedure. Because the number of days in each month varies, choose a date that will work for each month.

If you set the 31st of every month as the payment date, for example, February will never have as many wages paid as months within 30 days. The 1st or 28th day of each month should be used as the beginning date, and the 5th day of each month should be used as the ending date.

Insert A Payment Period

Insert payment intervals based on the frequency of payments, which might be once a week, twice a week, or once a month. The payment sheet template is modifiable and may be changed at any moment. You may delete any monthly payment plans that are no longer in use and set new ones.

What Is A Payment Schedule In Construction?

In response to a payment claim, you must serve the claimant with a payment schedule. A payment schedule must: indicate the planned amount of payment that you intend to make, if any (including "Nil"); If the payment is less than the amount claimed, provide all the reasons why.

How to Set a Construction Schedule and Pay Schedule

When Can You Schedule A Payment?

If you pay bills online, try setting up automatic payments for routine costs like energy and phone bills, and a one-time payment for others, like credit card bills, a day or two before the bill is due. This is a common misunderstanding.

Conclusion

A payment schedule template keeps track of all payments, payment amounts, and payment dates in a central location. It is very beneficial for businesses with a large number of workers, as well as lending institutions that must handle loans on a regular basis. A typical scenario is for a company to input employee information into a template to guarantee that everyone gets paid when they are supposed to. They list the sums and dates that are due next to the name on the invoice.