How To Create Free Budget Template In Simple Steps

Making a budget is an excellent method to keep track of where your money goes each month and is an essential step in putting your finances in order. A budget may help you meet financial goals like saving for an emergency fund or a down payment on a property.

While creating a budget may seem to be a challenging undertaking, it is not. Plus, once you have one, you've completed most of the work and may make small adjustments when your spending habits or income change. To begin with, there are a plethora of websites and budgeting tools to choose from, or you may make your own spreadsheet.

CNBC Select explains how to make a budget using a spreadsheet in the video below, although many of the procedures are similar to other budgeting approaches. Feel free to be creative with it; you may use Google Sheets, Microsoft Excel, and other sites to find templates or start from scratch.

Here Are Simple 5 Steps To Create Best Budget Template

Create a Budget in 5 Simple Steps

Calculate Your Net Income

The first step is to determine how much money you earn on a monthly basis. You'll need to figure out your net income, which is your gross revenue less your taxes. The amount given is likely your net income if you get a regular paycheck from your employment, whether part-time or full-time.

Keep in mind that if you have a health insurance plan, a flexible spending account (FSA), or a retirement account via your job, the money is often deducted from your paycheck automatically. To get a full view of your take-home salary, you'll need to remove those deductions.

You must deduct taxes from your income, whether you freelance, are self-employed, or simply do not get a regular paycheck. According to the IRS, the self-employment tax rate is 15.3 percent. This Tax Act calculator will help you figure out how much tax you'll have to pay in a year. You may then divide that number by 12 to obtain a monthly estimate.

Compile A List Of Monthly Expenses

The next step is to make a list of your monthly costs.

Here are some typical costs:

- Payments for rent or a mortgage

- Payments on a loan (such as student, auto and personal)

- Insurance is a kind of protection (such as health, home and auto)

- Utility services (such as electricity, water and gas)

- Subscriptions for the phone, internet, cable, and -

- Monthly Streaming

- Babysitting

- Provisions

- Getting around (such as gas, train tickets, and bus fares)

- Goods for the home

- Dining out

- Gym memberships on the road

- Differential (such as gifts, entertainment, and apparel)

Include information on how much you save each month, whether it's in a standard or high-yield savings account or a personal retirement account like a Roth IRA.

Distinguish Between Fixed And Variable Costs

Label whether your monthly costs are constant or variable after you've completed a list. Rent, utilities, transportation, insurance, food, and debt repayment are examples of fixed expenditures. Your gym subscription, for example, or how much you spend on eating out, are examples of variable costs. You could always cancel your gym membership and cut down on your eating out expenditures if money was tight, but you'll still have to pay rent or a mortgage.

Calculate The Monthly Average Cost Of Each Item

After you've separated your fixed and variable costs, make a monthly report of how much you spend on each. Bank and credit card statements may be used to track your spending.

Because the cost is consistent from month to month, fixed costs are simpler to track in your budget than variable ones. Debt payments on a mortgage or vehicle loan, for example, will cost the same every month.

However, since fixed utilities like electricity and gas, as well as variable expenditures like eating and home items, change from month to month, you'll need to perform some arithmetic to figure out the average. Determine the average monthly cost for these categories, as well as any others where your spending varies from month to month, by looking at three months' worth of expenditure.

Add up all of your grocery expenditures over the last three months and divide by three to get the average amount you spend on groceries. If you spend $433 on groceries on a monthly basis, you may wish to round up and set the spending limit to $450.

Make The Necessary Adjustments

The last stage in building a budget is to compare your monthly spending to your net income. If you find that your costs exceed your earnings, you'll need to make some changes.

For example, let's imagine your monthly net pay is $300 less than your costs. You should go through your variable expenditures and see if there are any methods to save $300.

This may include rethinking how much you spend on food, home products, streaming subscriptions, and other recurring expenses. To prevent debt, it's a good idea to cut these expenditures and make frequent modifications to the amount of money you spend.

If, after outlining your costs, you still have money left over, you may boost some parts of your budget. If you don't have an emergency fund, you should utilize this additional money to boost your savings.

However, you may spend the money on non-essential items such as eating out or vacations. Consider creating a high-yield savings account, like Marcus by Goldman Sachs High Yield Online Savings, to earn 16 times more interest than typical savings accounts.

How Do I Make A Monthly Budget?

Even if your income and regular expenditures aren't paid on a monthly basis, creating a monthly budget is an excellent way to get a better grasp of your finances. Divide the sum of a bill or your pay by 12 if you know how much it costs every year.

Remember to calculate council tax accurately—it's normally invoiced over the course of ten months. Multiply your monthly payment by 10, then divide by 12 to get how much you need to set aside for council tax.

Does Word Have A Budget Template?

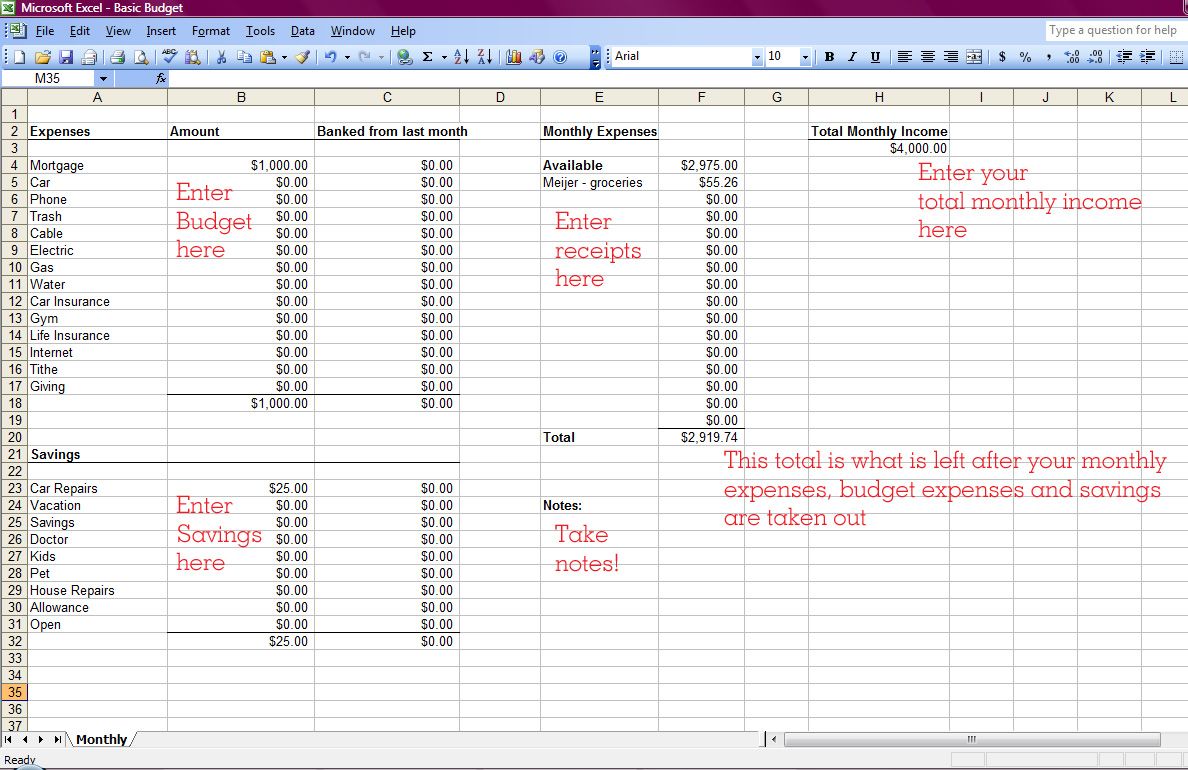

Create your own budget planner using Microsoft Word 2013 and a formula that can compute your weekly, monthly, or yearly costs for you. You may save the document as a Word DOCX document or as a Word DOTX template file, which you can edit each month as required.

Is There A Budget Planner In Excel?

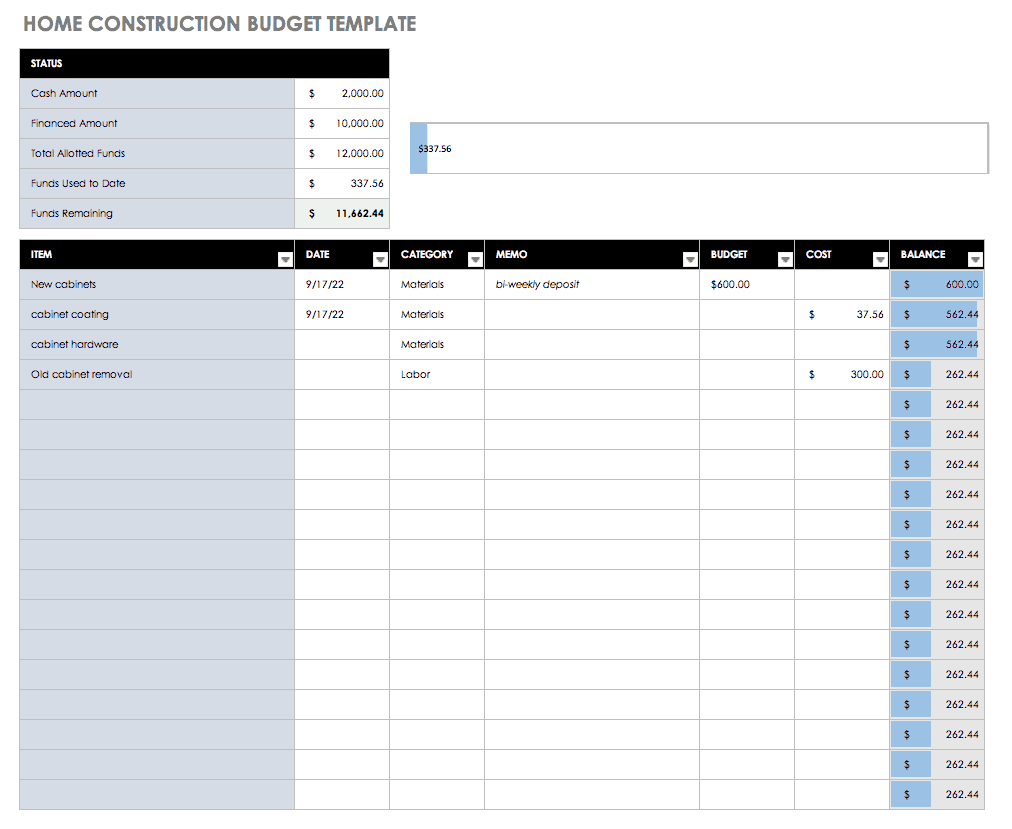

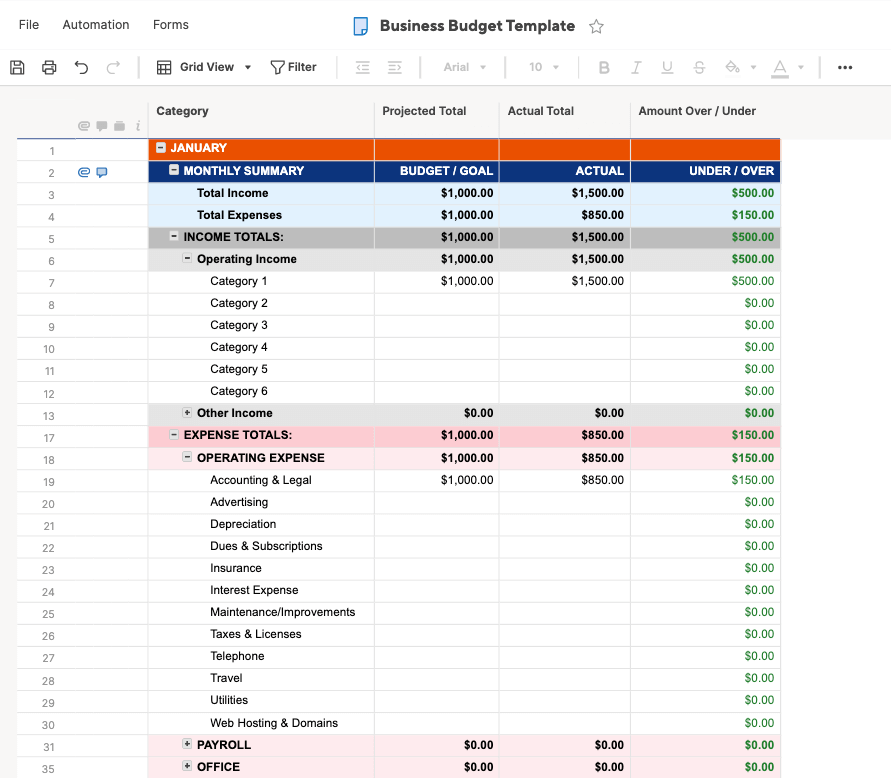

Make your own budget using the personal budget template. This Excel template may assist you in keeping track of your monthly budget based on income and spending. Simply enter your expenditures and income, and the difference will be computed automatically, allowing you to prevent deficits or prepare for predicted surpluses.

Conclusion

Your monthly budget worksheet is a roadmap for your business, helping you define priorities, understand where your business is going, and determine whether you’re on the right path. It’s a key factor when raising capital, whether you're applying for a loan or pitching investors, and it's a cornerstone of your business plan. It can help you minimize risk and experiment with how to best allocate resources. That’s why it’s so important to take the time to create an accurate and realistic budget that's specific to your business and goals.