Make Custom Budget Template: You Can Gain Control Over Your Finances By Creating A Personal Budget

Budget templates are financial papers that predict your revenue and expenses for a certain period of time. There is no set rule for what should be included in a company's budget template, but it should usually contain the following information:

- Revenue and sales forecasts

- Rent, utilities, and other overheads are examples of fixed expenses (i.e., expenditures that aren't affected by sales).

- Costs that change with time (i.e., costs related to sales, such as production expenses)

- Costs that are semi-variable (i.e., costs that may or may not depend on sales, such as marketing fees)

- Earnings (i.e., expected sales and income, minus your costs)

You may enter extra information like amounts/sources of investor financing in your budget planner template, depending on how detailed you want it to be. Companies with numerous locations may want to develop a budget template for each one.

Why Is A Budget Planner Template Important

Business budget templates are necessary for a variety of reasons, including the capacity to plan and monitor cash flow, income, and expenditures in order to achieve your financial objectives.

Money templates also enable you to plan for business slowdowns/busy seasons and allocate your budget to the parts of your organization that need the most funding. It's also a good method to see how budget changes affect you, plan for essential purchases, and estimate start-up expenses.

In the end, a budget spreadsheet template may assist you in keeping track of your money and bettering your financial planning.

The Importance of Budgeting

How To Produce A Business Budget Template

Although the procedures you'll need to follow to build a company budget template will likely vary based on what you include and the software you use to generate it, there are a few similar aspects to consider:

- Collect historical data: First and foremost, you'll need to gather historical data on a variety of things, including wages, operational costs, sales, and revenues. You may utilize financial data from a comparable firm as a benchmark if you're establishing a new business.

- Estimate sales: Now is the time to figure out how many sales you anticipate making during the year. Make careful to account for seasonality, holidays, and other factors.

- Establish profit objectives: After that, it's important to establish precise profit goals for your business, as well as realistic revenue forecasts for the whole year.

- Calculate your fixed and variable costs. Expenses are another important element of your budget template. Include all of your fixed (rent, licensing, insurance) and variable (materials, labor, benefits, and so on) expenses in the template.

- Calculate profit margin: You'll need to deduct costs from anticipated sales to get your firm's profit margin (i.e., how much profit you expect to earn). Include the cost of the products sold as well as any additional costs such as transportation and equipment.

- Adjust your budget over time: Finally, keep in mind that your budget is an alive, breathing document. It must be tweaked on a regular basis to evaluate how your forecasts compare to your actual sales.

Business Accounting How to Create a Budget *SIMPLE*

The Budget Template Includes The Following Sheets

BUDGET CONCEPT AND TYPES

Setup

Setup-fill in your company name, the budget reporting year, the suitable financial year-end date, and the budget reporting term. The business name appears as a heading on all sheets, and the reporting period selections determine the monthly periods that must be included on the trial balance and budget sheets, as well as the periods on which the month-to-date and year-to-date calculations on the income statement, cash flow statement, and balance sheet reports must be based.

Groups

This sheet includes all the pre-defined reporting classes that should be used to connect the trial balance accounts on the key sheet to the computations on the income statement, cash flow statement, and balance sheet.

Key

All of the individual accounts from the trial balance must be copied or put into this page, and each account number must then be connected to the correct reporting class. Based on the reporting class that is connected to each account on this sheet, all computations on the income statement, cash flow statement, and balance sheet are immediately updated.

TBPY

This sheet must include all of the account numbers and relevant monthly account balances that were included in the trial balance for the previous year's reporting period. By simply pasting the formula into all the rows that include an account number, the reporting classes in column A may be assigned to each account.

In order to enable correct cash flow calculations for the previous year’s financial period, the balance sheet balances for the year prior to the prior year’s reporting period must also be provided.

TBCY

This page must include all of the account numbers and relevant monthly account balances that are included in the trial balance for the current reporting period. By simply pasting the formula into all the rows that include an account number, the reporting classes in column A may be assigned to each account.

For each account included in the current period trial balance on the TBCY sheet, a cumulative monthly budget balance must be provided.

Budget

In order for the budget balances to be included properly on the income statement, cash flow statement, and balance sheet reports, all budgeted balances must be recorded on a cumulative basis (the same method used to generate any trial balance).

Negative numbers should be used to indicate income, equity, and liability account balances, while positive values should be used to represent expenditures and asset account balances.

IS

This sheet includes an income statement that is generated automatically using the reporting classes connected to the accounts on the key sheet. This page does not need user input, but you may modify the report if necessary.

The period choices on the Setup sheet define the month-to-date and year-to-date periods for which the income statement is produced.

CFS

This sheet includes a cash flow statement that is generated automatically using the reporting classes connected to the accounts on the key sheet. This page does not need user input, but you may modify the report if necessary.

The period choices on the Setup sheet define the month-to-date and year-to-date periods for which the cash flow statement is produced.

BS

This sheet provides an automatically generated balance sheet based on the reporting classes connected to the accounts on the key sheet. This page does not need user input, however, you may modify the report if necessary.

The period choices on the Setup sheet define the month-to-date and year-to-date periods for which the balance sheet is produced.

ISMonth

This sheet provides a monthly budget income statement that is generated automatically using the reporting classes connected to the accounts on the key sheet.

This page does not need user input, but you may modify the report if necessary. The budgeted amounts on the Budget sheet are used to create the monthly income statement, and the monthly periods for which the income statement is generated are defined by the period choices on the Setup sheet.

TBCheck

When copying a trial balance from another Excel workbook into this template, double-check that the account numbers on the source worksheet match the account numbers on the target trial balance worksheet.

As a result, we've provided this page so that customers may double-check that their account number sequence matches the proper trial balance before putting the data into this template.

To get started with the template, just follow the instructions below:

- On the Setup sheet, change the default values in the cells with yellow cell backgrounds.

- If you don't want to utilize your own account structure and instead want to use our standard template configuration, all you have to do is fill in your cumulative monthly balances on the three trial balance sheets and leave the Key sheet blank.

- The income statement, cash flow statement, and balance sheet will be automatically filled with all of the reporting classes that are connected to the relevant account balances.

- Replace our default data with your own by copying the account numbers and descriptions of all the accounts on your trial balance onto the Key sheet, then linking each individual account to the proper reporting class by copying or typing the class code into column C.

- On the Groups page, you'll find a complete list of all the major classes utilized on the income statement and balance sheet.

- If you have more accounts than the default data in the template, copy the account numbers to the TBPY, TBCY, and Budget sheets, as well as the formulae in columns A and C.

- Copy all the previous financial year balances to the TBPY sheet, all current financial year balances to the TBCY sheet, and all budget balances for the next financial year to the Budget sheet.

- All trial balance figures must be added together.

- Based on the numbers on the three sample balance sheets, the income statement, cash flow statement, and balance sheet are automatically computed.

- On the Setup page, just choose the appropriate reporting period, and all calculations will be updated immediately.

Why You Need A Business Budget Template

For company owners who care about their bottom line, a business budget template is a must-have tool. Why should you start by investing in a smart template? A company budget template may help you succeed in the following ways:

- Maintain a record of your financial flow, expenditures, and income.

- Expect business slowdowns on a frequent basis.

- Allocate your money to the areas of your company that need the greatest funding.

- Make a budget for company purchases and investments.

- Estimate the expenses associated with establishing and operating your company.

In general, if you spend time and effort correctly building up your company's budget template, it may serve as a business health scorecard. To help you accomplish exactly that, we've compiled a selection of the finest budget templates accessible.

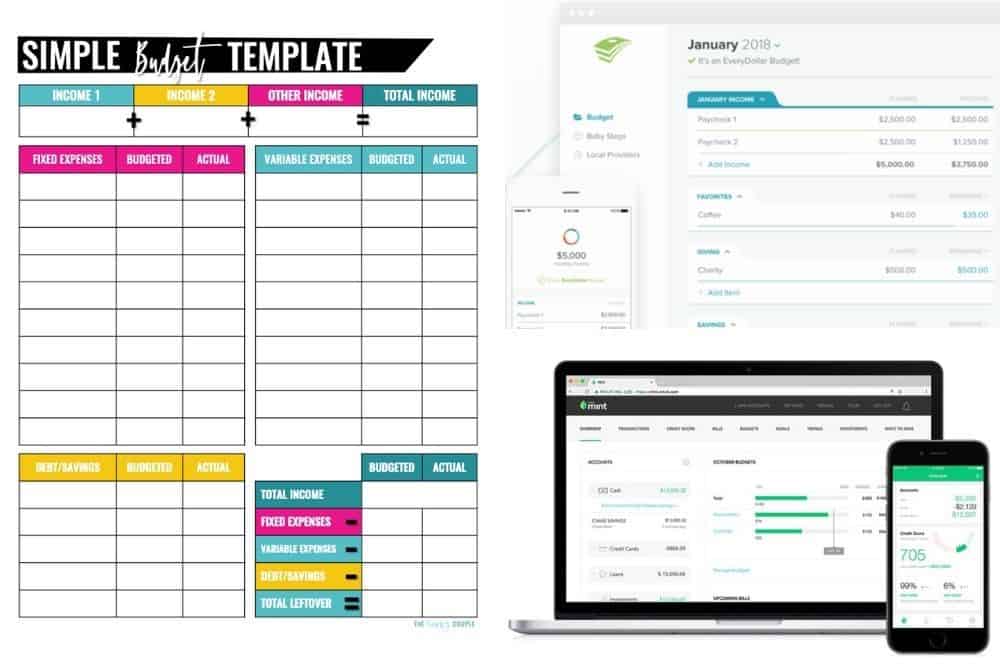

Best Budget Templates And Apps

BEST BUDGETING APPS PH | Managing Your Finances | Budgeting Basics

Budgeting Templates For Google Sheets

Yes, there are free budget templates available in Google Sheets. If you're a data nerd, a Google Sheets budget template may be a good fit. You'll have to manually input all of your expenditure information.

If you primarily spend with a plastic card, this may mean collecting receipts each month or going through your bank statements. Budgeting using Google Sheets

Overall, utilizing a Google Sheet budget template to monitor your budgeting success is not a particularly visible method to do so. The statistics, on the other hand, do not lie.

You'll be able to monitor how much you're spending and create strategies to reduce it. Although inputting the data takes effort, it may help you get a better understanding of your purchasing habits.

As you put purchases into your budget spreadsheet, you'll be forced to relive each one. The official Google Sheets Budget template may be found here. It's simple, yet it allows you to keep track of your monthly expenses.

If you want to use this sheet, you must first request access to it and then make a duplicate of it. You'll be able to make changes and monitor your budget in your own account after creating a copy. You can create your own Google Sheet if you don't like the free budgeting templates.

Budget Template For Microsoft Excel

Excel has budgeting templates that are comparable to those found in Google Sheets. You may, however, have to pay for them. If you don't already have Microsoft 365, you'll have to pay to use Excel's budgeting templates.

Budget Spreadsheet in Excel The template, like Google Sheets, needs you to manually fill in the data. It may take some time to get used to the new format. However, it may be a useful tool for considering where your money goes each month.

Consider creating your own spreadsheet if you want to use Excel but don't want to pay for the premium version. To monitor our finances, I use an Excel file that I created myself.

Every month, I keep track of our purchases to see how much we spent over or under budget for the month. If you know how to use Excel, it may be a fantastic free alternative.