Budgeting Tips For Beginners In 2021

Budgeting is the dreaded B-word.

Unfortunately, the word budget has a negative connotation. When it comes down to it, a budget is nothing more than a financial plan. Budgeting entails planning your spending before the month begins. Unfortunately, many people see a budget as a constraint that prevents them from pursuing their goals.

However, nothing could be further from the truth! A budget does not limit your freedom; rather, it enhances it! It's all about being deliberate about where your money goes. Let’s talk about some budgeting tips for beginnersyou totally can do.

What Is A Budget?

A budget is a forecast of revenue and expenses for a specific future period of time that is usually prepared and updated on a regular basis. Budgets can be created for an individual, a group of individuals, a company, a government, or almost anything else that generates and spends money.

Budgeting is essential for managing monthly spending, preparing for life's unanticipated occurrences, and being able to finance big-ticket things without falling into debt. Keeping track of your income and expenses doesn't have to be a chore; it doesn't require you to be a math genius, and it doesn't mean you can't buy the items you want. It simply implies that you'll know where your money is going and that you'll have more control over it.

A budget is a microeconomic concept that depicts the trade-off that occurs when one good is substituted for another. In terms of the bottom line—or the end result of this trade-off—a surplus budget anticipates profits, a balanced budget anticipates revenues equaling expenses, and a deficit budget anticipates expenses exceeding revenues.

Why Do You Need A Budget?

You will always have enough money to pay for the things that you need and care about since budgeting allows one to make a spending plan for their money. In addition, sticking to a budget or spending plan will help you stay out of debt, or at the very least, get out of debt.

Different Types Of Budgeting

While most people utilize a variety of several sorts of spending plans, they do not adhere to a single, rigid budgeting method exclusively. Some of the most popular budgeting approaches are listed here.

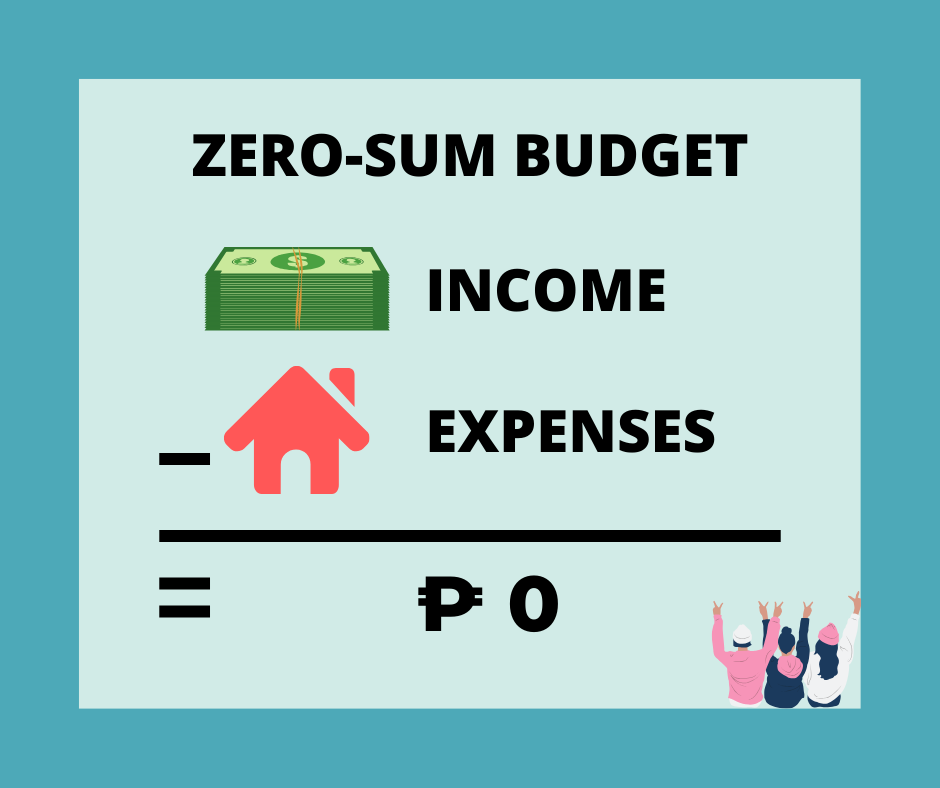

Zero-Sum Budget

The zero-sum budget is the foundation of Dave Ramsey's methodology. The idea is to budget out your income and expenses such that the ultimate result is zero at the beginning of the month (or pay period).

It's crucial to understand that a zero-sum budget does not imply that you'll have no money at the end of the month. Your savings (and buffer money) will be factored into your monthly spending.

Cash-based Budget

A cash-based budget is another sort of budget that is ideal for overspenders. A cash-based budget is exactly what it sounds like: it's based on cash. The cash envelope system is another name for a cash-based budget.

The cash envelope technique is a great way to check how your budget is working in real-time. While you definitely won't use the cash envelope approach for all of your budget categories, it's ideal for budget-busting ones like food (including groceries and restaurants), wardrobe, entertainment, and transportation.

Here's how it works: settle on an adequate amount for each budget category at the start of the month. Then, take that money out of your bank account and divide it among the envelopes labeled with the budget categories.

When the money in the envelope is depleted, you must either stop spending in that category for the month or reallocate funds from another envelope if you have enough. Reevaluate the budget categories at the end of the month and make any required adjustments.

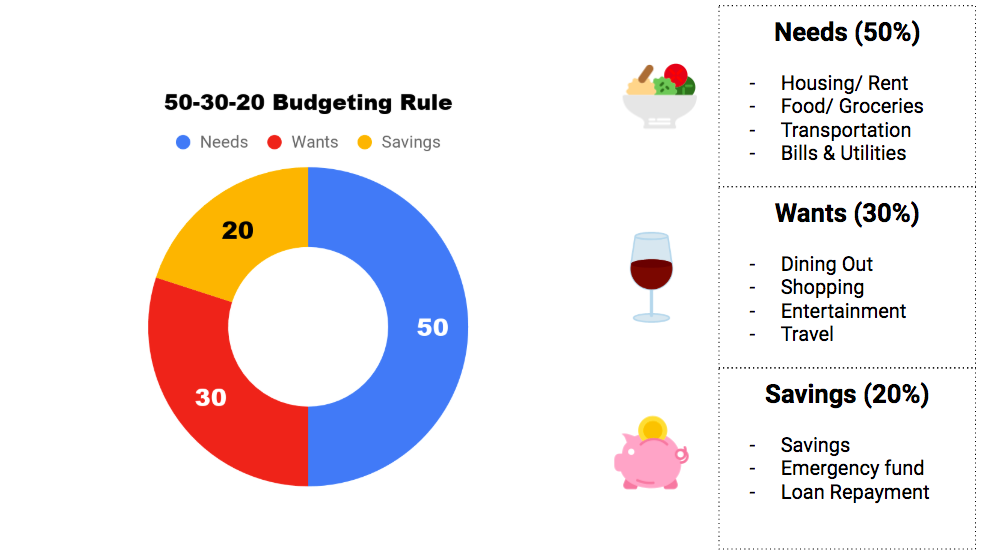

50/30/20 Budget

Senator Elizabeth Warren popularized the 50/30/20 budgeting strategy in her book All Your Worth: The Ultimate Lifetime Money Plan.

The percentages that make up the 50/30/20 budget plan are as follows:

- Housing, food, transportation, health care, basic clothing, and minimum debt payments are all budgeted at 50%.

- Entertainment, streaming services, restaurant meals and takeaway, accessories, cosmetic services, and gym membership are all budgeted for at 30%.

- 20% of the budget is set aside for savings, investments, and (additional) debt repayment (emergency fund, stocks, mutual funds, retirement accounts, and extra debt payments).

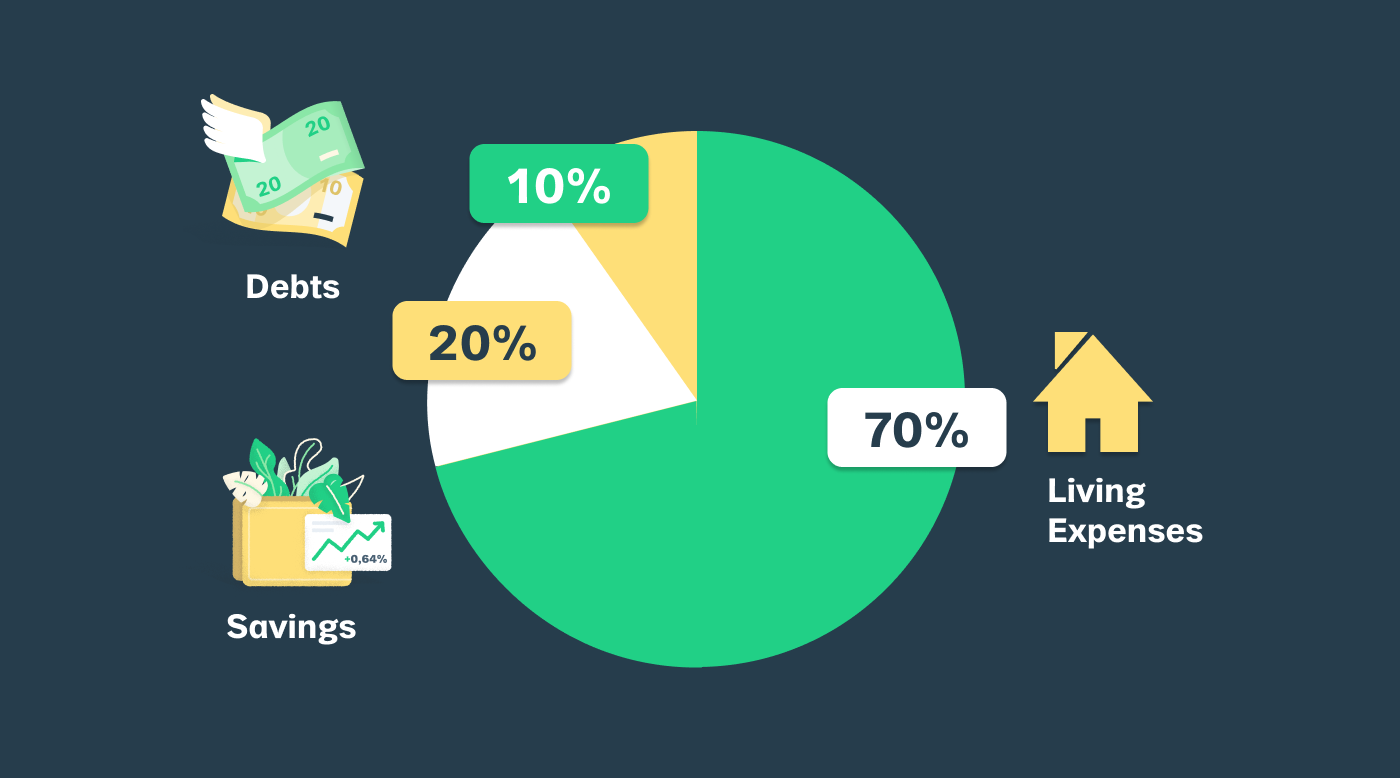

The 70 20 10 Budget

50-30-20 or 70-20-10? If you recognize either of those numerical groups, you've probably come across or sought out popular budgeting advice.

The percentage breakdowns for spending, saving, and sharing money are 70-20-10 and 50-30-20, respectively. Using the 70-20-10 rule, a person would spend only 70% of their income each month, save 20%, and then donate 10%. The 50-30-20 rule applies in the same way.

Bare-Bones Budget

A bare-bones budget consists of solely budgeting for your essential costs (which have been reduced as far as possible).

If you or any of your family has just lost your job or received a wage cut this pandemic, a bare-bones budget can help you get back on your feet. Begin by asking yourself the following question: Which of my costs are absolutely necessary for my survival?

Only the following categories are included in a bare-bones budget:

- Rent/mortgage is a type of housing.

- Utilities include electricity/gas, water/sewer, and garbage collection.

- Restaurant meals and takeout are not included in groceries.

- Work, errands, and doctor's visits all require transportation.

- Home, auto, life, and health insurance are all available.

- Check to determine if you qualify for state-run health insurance if your income has been reduced or eliminated.

- Minimum Debt Payments: Make minimum payments on your mortgage/rent, automobile, credit cards/loans, and other debts as much as possible.

- a basic cell phone or a landline

Any money left over after filling these budget "buckets" should be put toward savings, paying off debt, and catching up on past obligations.

As you may guess, living on a bare-bones budget isn't much fun. It's intended to be utilized in times of financial hardship. If you find yourself needing to use this budget for more than 6 months, you may need to discover other ways to supplement your income.

Budgeting Tips For Beginners

Are you ready to begin? The top 15 budgeting tips are listed below!

Before The Month Begins, Reduce Your Budget To $0

This implies you're developing a strategy and giving each dollar a name before the month even begins. A zero-based budget is what it's called. That isn't to say you have no money in your bank account. It simply means that your revenue minus all of your outgoings equals zero.

Work Out A Budget As A Team

Every month, hold a family budgeting night if you're married. Enjoy yourselves! Put on a decent soundtrack, grab some food, and get ready to focus. Getting on the same page with money means setting goals and imagining what the future holds. Your bank accounts should be one if you're a couple! No longer are we dealing with your money or mine; it's our money.

Also, if you're single, locate a companion who can hold you accountable for your goals!

Keep In Mind That Each Month Is Unique

You'll need to budget for items like back-to-school supplies and routine car maintenance for certain months. You'll be saving for vacations, birthdays, and holidays during the other months. Whatever the occasion, make sure you account for those costs in your budget. Pull up your calendar as you're making your budget to keep those special dates from sneaking up on you. (Hint: Christmas is back in December this year!)As circumstances change, make careful to alter your budget each month. Make a savings account that you can add to throughout the year. You will be stressed if you do not have a plan in place. And that detracts from the joy of gifting and celebrating. That is something that no one desires!

First, Go Over The Most Significant Categories

Giving and saving come first, followed by the Four Walls of food, utilities, housing, and transportation. After you've taken care of your basic needs, you may fill in the rest of your budget categories.

Clear Your Debt

If you have debt, it should be your first priority to pay it off. To get out of debt as quickly as possible, use the debt snowball strategy and the 7 Baby Steps. Take it on! Become enraged! Stop allowing debt to steal you of the exact thing that allows you to succeed financially: your income.

Don't Be Frightened To Make Budget Cuts

Prepare to be surprised! It might be time to make some financial sacrifices in your life. If money is tight right now, canceling cable, eating out less, and shopping at discount apparel and grocery stores are all simple ways to save money. Keep in mind that the budget cuts you're making are only temporary. You can always change your mind afterward.

Make A Timetable (And Stick To It)

Why not set precise dates for other costs while you're making a budget a part of your regular routine? To pay your bills, you could set up auto drafts from your bank account. You might also buy your groceries on a regular basis, such as once a week or twice a month. You eliminate a lot of tension and potential difficulties when you know what to expect and when to expect it.

Keep Tabs On Your Progress

It's crucial to keep track of your development from time to time. If you're married, sit down and discuss your goals. If you don't have anybody to check in with, find someone who does. Discuss how budgeting is assisting you in moving forward. Consider how you may reduce your expenditure or perhaps earn more money to help you achieve your goals faster. Also, don't forget to congratulate yourself on tiny victories.

Make Room In Your Budget For A Contingency

Set away a little amount of money each month for unforeseen needs. In your budget, put this in the miscellaneous area. That way, if something unexpected happens, you'll be able to cover it without having to take money from somewhere else. Keep track of expenses that fall into this category often. You could even wish to make them a permanent part of your budget in the future.

Cut Your Credit Cards In Half

If you're serious about sticking to a budget and getting out of debt, you'll have to put your credit cards away for good. Stop relying on them! Cut them up, shred them, or use them for a craft project! Get them out of your life in any way you can.

There will be no more minimum payments to add to the budget, no more fees or excessive interest rates to deal with, and much less stress and concern. Use your debit card (or even cash!) instead of credit cards, which you should discard like your ninth-grade fling. What's the best thing about having a debit card? The money is taken directly from your bank account! There is no middleman who will charge you 15% interest.

Use Cash For Any Budget Categories That Are Causing You Problems

Cash-out those categories and use the envelope system to hold you accountable if you're continually overpaying on your grocery budget or leisure money. Simply go to the bank and withdraw the amount of money you've set aside for that category. Stop spending when the money runs out! It's your go-to accountability buddy.

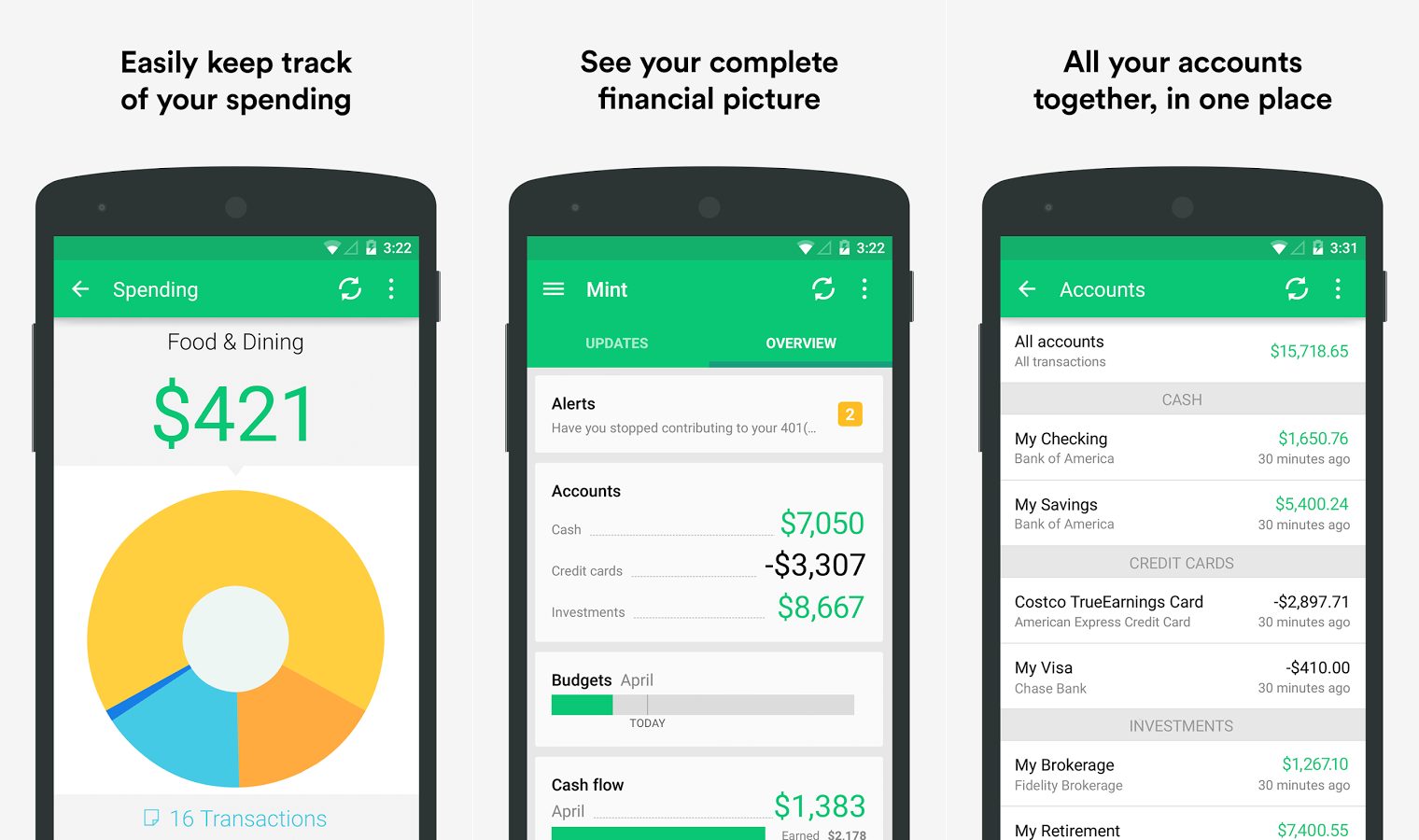

Make Use Of An Online Budgeting Tool

If you prefer not to use pen and paper (or spreadsheets), it's time to join the 21st century and utilize a budgeting tool like EveryDollar. From the convenience of your smartphone, you can set a budget and track your expenditures! You may also sync your budget with your spouse, which is a terrific way to keep the lines of communication open.

Be Happy With What You Have And Stop Comparing Yourself To Others

You have a lot more than you think. Make no comparisons to other people's situations. Not only will comparison steal you of your joy, but it will also drain you of your income. Continue to move forward and do what is right for your family.

Set Goals For Yourself

Whether you're paying off student loans, putting money aside for an emergency, or paying off your mortgage, you need to remember why you're doing it. What motivates you to make these sacrifices?

Allow Yourself A Lot Of Leeways

Getting a handle on the budgeting process normally takes three to four months. It won't be ideal the first or second time. But you'll make it!

Ways To Budget When You’re Broke

Budgeting tactics seem good, but if you're in serious financial trouble or are facing growing costs and a shortage of finances, there are some additional options.

Stay Away From Immediate Disaster

Don't be scared to ask creditors for bill extensions or payment plans. Skipping or delaying payments can only make your debt worse, and late fines will lower your credit score.

Make A List Of Bills That Need To Be Paid First

Examine all of your bills to determine which ones must be paid first, and then create a payment plan based on your paydays. If some of your expenses are already past due, you'll want to set aside some time to catch up.

If this is the case, contact the bill collectors to see how much you can pay right now to get back on track. Tell them you're putting forth a lot of effort to catch up. Don't merely promise to pay the full amount late; be honest about how much you can afford to pay.

Ignore The Ten Percent Rule When It Comes To Saving Money

When you're living paycheck to paycheck, putting 10% of your income into a savings account can be difficult. If you're fighting debt collectors, having $100 in a savings account makes little sense. Until you can establish financial stability, your piggy bank will have to go hungry.

Examine Your Spending

To get a grasp on your finances, you must first have a handle on your spending. Online banking and budgeting tools can assist you in categorizing your spending and making adjustments. Many people find that simply glancing at aggregate data for discretionary expenditure motivates them to improve their spending habits and cut back on unnecessary spending.

Cut Costs That Aren't Necessary

It's time to tighten up once you've figured out where the money goes. All cuts should begin with goods you won't miss or behaviors you'd like to modify anyway, such as limiting your fresh food purchases if you find that ingredients deteriorate before you can use them. Alternatively, instead of eating out or ordering takeout, spend more time preparing meals at home.

Switching carriers to lower your vehicle insurance rate is one item you shouldn't cut, but you might be able to change.

Negotiate Interest Rates On Credit Cards

There are a variety of other proactive approaches to cut costs. Those exorbitant interest rates on your credit cards, for example, aren't set in stone. Call the credit card issuer and request a lower annual percentage rate (APR); if you have an excellent credit history, your request may be granted. This will not reduce your outstanding debt, but it will slow its growth.

Maintain A Budget Journal

After you've completed these steps, keep track of your progress for a few months. This can be done by keeping track of everything you spend in a notebook, using budgeting applications on your phone, or using the tools you used to examine your spending in step 4.

It's less important how you track your money than how much you track. Divide your costs into categories to ensure that every bit is accounted for. After each month, fine-tune and alter your spending as needed.

Find A New Job

Saving and investing money is out for the time being. In addition to working extra and acquiring a second job or picking up some freelance work as options to enhance your income.

Creating a budget isn't like locking yourself in a cell to keep your money from you. Your future will be better—and yes, richer—because of it.

Conclusion

However we look at it, this pandemic is not going to end soon. So what we can do now is be wise with our spending, for our own sake and our family’s. Hope the tips here can help you be more budget savvy.