Tips For Writing A Will Template - A Step-By-Step Guide

On a random Sunday in the park, a last will and testament is probably the last thing you want to think about. It's also one of those things you'll be pleased you took the time to do.

Whether it's for fun or not, we should all think about what would happen if we died. If you're a parent or have individuals who rely on you, writing a will is very crucial.

How to Write a Last Will and Testament | PDF | Word

What Is The Difference Between A Last Will And Testament And A Living Will?

A last will and testament is a legal document that expresses a person's last desires about his or her possessions and dependents. A person's final will and testament specifies what happens to their property, including whether they will be left to another person, a group, or donated to charity, as well as what happens to other items they are responsible for, such as child custody and financial management. Non-standard or atypical wills, such as a holographic will, are permitted in certain states but not in others.

Takeaway- Important

- If a parent dies without leaving a will, the courts will appoint a guardian for their minor children.

- If you die intestate, the courts will settle your estate, which includes the allocation of all assets.

- If you write a will and testament, you have some influence over what happens to your possessions when you die.

- The probate court does not apply to trusts or life insurance plans with designated beneficiaries.

- Wills may now be written at a reasonable price by utilizing an online will maker.

What Is A Last Will And Testament And How Does It Work?

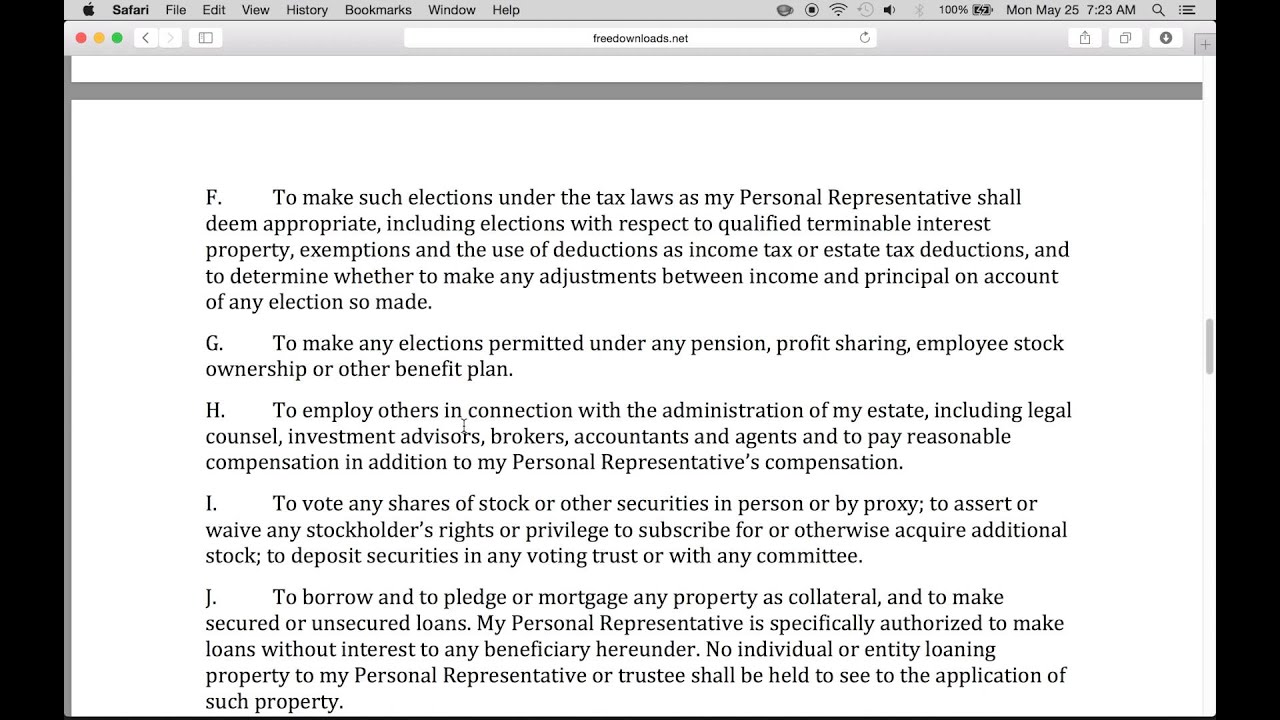

A will is written while the person is still living, and the instructions are only carried out when the person passes away. A will appoints a person who is still alive as the executor of the estate, and that person is in charge of running the estate. The executor is frequently overseen by the probate court to ensure that the will's intentions are carried out.

The cornerstone of an estate plan is a will and final testament, which is the fundamental tool for ensuring that the estate is settled in the way requested by the deceased. While an estate plan might include more than just a will, it is the governing document that the probate court uses to lead the estate settlement process.

Any assets that have not yet been identified by a beneficiary, such as a life insurance policy or a qualified retirement plan, are not considered probate assets and transfer to the beneficiaries immediately.

10 Easy Steps For Creating & Writing A Will Template

Although most individuals should have a will, it is seldom the most important estate planning document. Many assets in a normal home may be transferred outside of a will by designating beneficiaries, and papers like financial and medical powers of attorney can be more potent in influencing the result of an inheritance.

Even so, having a will that is poorly worded or out-of-date may be expensive and cause an otherwise well-planned estate to fall apart. Wills are especially crucial for those with dependent children since they are the best way to appoint guardians for children in the event that both parents pass away.

Experts often urge people to have their basic estate planning paperwork in place around the time they get married or purchase a house, and to review their will on a monthly basis, with a focus on this process around the time they retire. In ten easy stages, you may get started and finish your will:

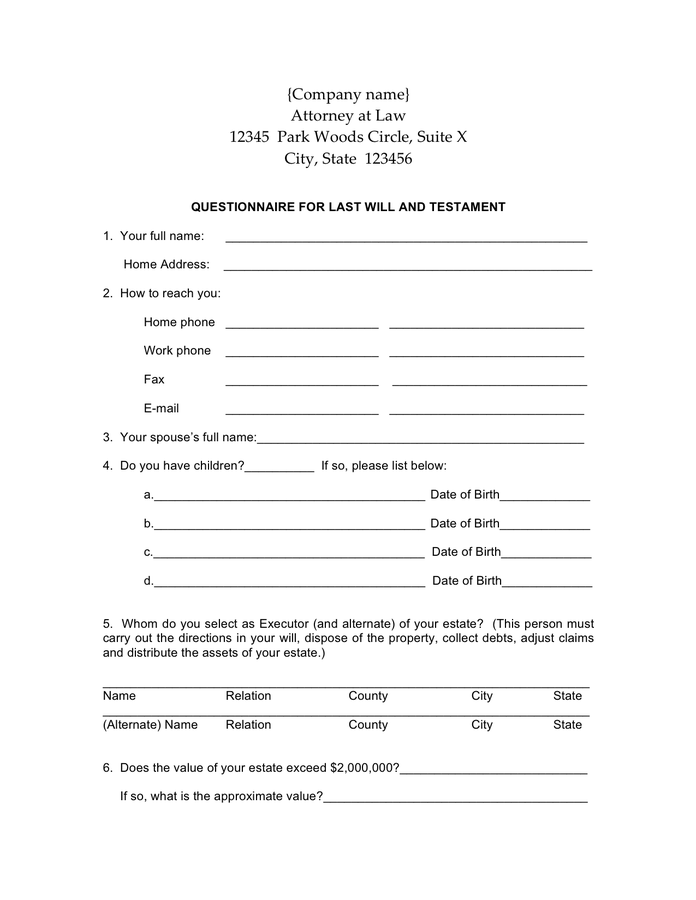

- Use a do-it-yourself software package or hire an estate planning attorney.

- Make a list of your beneficiaries for your will.

- Make a decision on who will be the executor of your will.

- Choose a guardian for your children.

- Make it clear who gets what.

- Be practical when it comes to who gets what.

- A letter should be included with the will.

- Make sure you sign the will correctly.

- Locate a suitable location for your will.

- Examine and revise your will.

Use A Do-It-Yourself Software Programme Or Hire An Estate Planning Attorney

Individuals or families in relatively straightforward financial conditions may be able to create their wills using an online, reliable software tool. Boost WillMaker's performance and put your faith in Fabric. Consider the following software programmes:

LegalZoom:

Many cases, on the other hand, will need the assistance of an estate planning attorney. Patrick M. Simasko, an elder law attorney in Mount Clemens, Michigan, adds, "There are so many restrictions that come into play."

They can't get to the lawyer, so they go to LegalZoom, which is fantastic, and write their own paperwork, go to a website, and download the will, trust, or other forms. They don't know how to properly fill them out, sign them, or notarize them, therefore they're worthless."

A few thousand dollars may be spent on hiring an attorney to draught simple estate planning paperwork, but an internet software application can be purchased for $100 or less. Experts caution, however, that poorly written agreements may be expensive in the long run.

Beneficiaries to be chosen:

When it comes to estate planning, one of the most frequent mistakes people make is forgetting to identify or update beneficiaries on crucial accounts that interact with the plans described in their wills. "What's mentioned on all of the bank accounts, life insurance, and property," Simasko explains, "controls what goes where." "The will is superseded by the beneficiaries mentioned, but there is frequent inconsistency."

Choose The Executor

The executor of your will is in charge of seeing that your desires are carried out. This person is usually a family member or someone from the outside who is responsible and detail-oriented.

"You can always designate your attorney or CPA if you have no children, no nephews or nieces," says Brian J. Decker, owner and creator of Decker Retirement Planning, which has many sites on the West Coast. Because of the cost, a corporate trustee is a major no-no. Even if they don't accomplish anything, they charge 1% of the estate every year, and they demand you to keep all of your assets with them, so it's a double dip," he says.

Choose A Guardian For Your Children

Individuals with dependent children should be sure to designate a guardian in their wills. While it is not necessary to get authorization before designating someone as a guardian, it is standard practice to identify many guardians in the event that one of the named guardians is unable to accept guardianship.

Make It Clear Who Gets What

Choosing which assets to include and identifying who will get what may be one of the most time-consuming components of writing a will. To aid in decision-making and management, Stanley Kon, co-founder and chairman of Ripsaw Wealth Tools in Colorado, believes that people should analyse the sorts of assets being distributed to heirs.

In an email, Kon added, "Grandchildren will have a very long-term investing perspective and will have a higher risk tolerance than their children." An educational fund will most likely have a considerably shorter investment horizon and a lower risk tolerance than a traditional mutual fund. This method may be used to determine how much money you'll need to support your estimated remaining life vs. how much money you'll need to give beneficiaries, and then manage your money appropriately. "

Be Honest About Who Gets What And Who Doesn't

It's critical to consider how assets will be allocated in a realistic manner. According to Decker, the most common cause of children ceasing to talk following a parent's death is boilerplate language instructing physical possessions to be distributed evenly among children.

"If you have three kids who all play the piano and speak the same basic language," he argues, "the first one is going to select the Steinway." It is impossible to split physical assets evenly. Because of this, you will have children with "difficult ties once the wealth is dispersed."

Please Include A Letter

Individuals might include a letter of explanation in their will. This letter may be used to say farewell in a more personal manner, as well as to elaborate on specific requests.

Fill Out The Will Properly:

If a will is executed incorrectly, it may be declared void. Witnesses are required to sign your will, and in many states, the witnesses cannot be beneficiaries of the will. Your witnesses must also be over the age of 18.

They should ideally be folks who will be around when you aren't. If anything goes wrong and your will is challenged in court, a witness may be called to testify. The number of witnesses required may also vary from state to state.

Locate A Location For Your Will

Make sure someone you trust knows where your will, as well as any other critical paperwork and financial institution passwords, are kept. It's also a smart idea to keep the original copy safe, such as in a fireproof safe.

Wills may be preserved and even performed electronically in rare situations. These electronic wills, sometimes known as e-wills, are only legitimate if they fulfil specific standards, such as being in text format rather than audio or video, and complying with state restrictions about whether witnesses must be present or distant.

Examine And Revise Your Will

According to Daniel R. Bernard, a lawyer at Twomey, Latham, Shea, Kelley, Dubin & Quartararo LLP in New York, wills should be amended every five years. "This doesn't always happen," Bernard noted in an email, "similar to having your car's oil changed every three thousand miles."

Another excellent rule of thumb is to examine your documentation if you experience a big life event, such as the birth of a new kid or grandchild, a divorce, or the loss of a spouse or parent, for example.

Conclusion

A last will and testament is a document that you make while you're still alive and then have carried out after your death. It's a vital part of your estate plan because it guarantees that your affairs are handled the way you want them to be, including who gets your assets and who will be the legal guardian of your minor children. A will may also contain provisions for surviving accounts or the care of another person, such as a parent who is old.

Another person is named as an executor of the estate in the last will and testament, and that person is in charge of overseeing the estate's administration. The executor is usually overseen by the probate court to ensure that all of the desires in the will are carried out. A final will and testament must be written by a person of sound mind and mental capacity in order to be legally legitimate. Other requirements, such as the signatures of two unrelated adults, are common in most states.